Our global expertise gives

us a different perspective on

US markets

us a different perspective on

US markets

A differentiated US Equity investment solution

GQG Partners is based on two primary principles: To put client alignment first and deliver world class performance.

Read MoreAdaptability is important when it comes to generating alpha

Generating relative outperformance with a lower volatility profile and stronger downside risk management requires adaptability, in our opinion.

Read MoreInvesting unconstrained by style

Our unconstrained approach focuses on conviction-weighted company and sector exposures.

Read MoreForward-Looking Quality in action

Forward-Looking Quality focuses on qualitative assessments of barrier to entry, sustainability of earnings, and overall industry dynamics to direct our research process.

Read More

Pursuing consistent performance across changing market conditions

Our portfolios seek consistent, long-term outperformance while managing downside risk.

Read More

Learn More about GQG’s US Equity Strategy

| TOTAL RETURNS AS OF 30 JUN 2025 | 1 MO | 3 MO | YTD | 1YR | 3YR | 5YR | 10YR | SINCE INCEPTION(01 JUL 14) |

| US Equity Strategy (net of fees) % | 1.56 | -1.24 | -2.23 | -0.68 | 13.73 | 14.75 | 15.42 | 14.80 |

| S&P 500 % | 5.09 | 10.94 | 6.20 | 15.16 | 19.71 | 16.64 | 13.65 | 13.07 |

The Composite does not include any wrap fee paying clients for the periods shown and the net of fee performance does not reflect all fees that may be incurred by a wrap fee paying client. The net of fee Composite performance would be reduced by the impact of wrap fees paid.

GQG Partners LLC claims compliance with the Global Investment Performance Standards (GIPS®) and has prepared and presented this performance information in compliance with the GIPS standards. GIPS® is a registered trademark of CFA Institute. CFA Institute does not endorse or promote this organization, nor does it warrant the accuracy or quality of the content contained herein. GIPS composite reports may be obtained by emailing clientservices@gqg.com.

Performance data is based on the firm’s composite for the strategy. The composite was created in June 2016. Performance presented prior to June 1, 2016 was achieved prior to the creation of the firm. The prior track record has been reviewed by Ashland Partners & Company, LLP and conforms to the portability requirements of the GIPS standards. On June 28, 2017, ACA Performance Services, LLC acquired the investment performance service business of Ashland Partners & Company, LLP. For periods after June 1, 2016, the composites consist of accounts managed by GQG pursuant to the strategy.

The US dollar is the currency used to express performance. Returns are presented net of management fees and include the reinvestment of all income. Net performance is calculated after the deduction of actual trading expenses and other administrative fees (custody, legal, admin, audit and organization fees). Net returns are calculated using the highest/model rack rate fee. Net performance is net of foreign withholding taxes. Returns for periods greater than one year are annualized.

FOR FINANCIAL PROFRESSIONAL USE ONLY. NOT FOR DISTRIBUTION TO THE PUBLIC.

IMPORTANT INFORMATION

PAST PERFORMANCE MAY NOT BE INDICATIVE OF FUTURE RESULTS

GQG Partners LLC (“GQG”) is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

The information provided on this website has not been audited; does not constitute investment advice; is not a recommendation to follow any strategy or allocation; should not be substituted for the exercise of one’s own judgement; and no investment decision should be made based upon it. In addition, neither is it a recommendation, offer, or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any recommendations made by GQG will be profitable or will equal the performance of any securities discussed herein. This website reflects the views of GQG as of a particular time; these views may change without notice. Any forward-looking statements or forecasts are based upon assumptions and actual results may vary. GQG provides this website and its content for informational purposes only. While GQG has gathered the information in good faith from sources it deems to be reliable, GQG does not represent or warrant that any information, without limitation, is accurate, reliable, or complete, and it should not be relied upon as such.

Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory, and foreign currency requirements for any investment according to the law of your home country, place of residence, or current abode.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objective. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in any strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objective(s) and risk tolerance. There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

INFORMATION ABOUT REPRESENTATIVE ACCOUNTS

Portfolio characteristics, top ten holdings, sector allocation, country allocation, ROE and market capitalization are based on a representative portfolio, which is the account in the composite that GQG believes most closely reflects the current portfolio management style for this strategy. Performance is not a consideration in the selection of the representative portfolio. The information for the representative portfolio shown may differ from that of the composite, however, performance for the representative portfolio is generally not materially higher than the performance of the composite. The top ten holdings identified and described do not represent all securities purchased, sold, or considered for clients in the composite and no assumption should be made that such securities or future recommendations were or will be profitable in the future. Portfolio holdings are subject to change without notice. Country allocations shown reflect the country of risk of the securities in the portfolio as assigned by Northern Trust (NT), though GQG’s portfolios are constructed based on GQG’s assessment of each issuer’s country of risk exposure, which may not be the same as NT’s country assignment. GQG assesses the country’s economic fortunes and risks to which it believes the issuer’s assets, operations and revenues are most exposed by considering such factors as the issuer’s country of incorporation, actual physical location of its operations, the primary exchange on which its securities are traded and the country in which the greatest percentage of its revenue is generated.

INFORMATION ON RISK STATISTICS

Standard Deviation: Absolute volatility measured as the dispersion of monthly returns around an average. Alpha: Outperformance measured as risk-adjusted excess returns over the benchmark. Beta: Relative volatility measured as systematic risk relative to a benchmark.

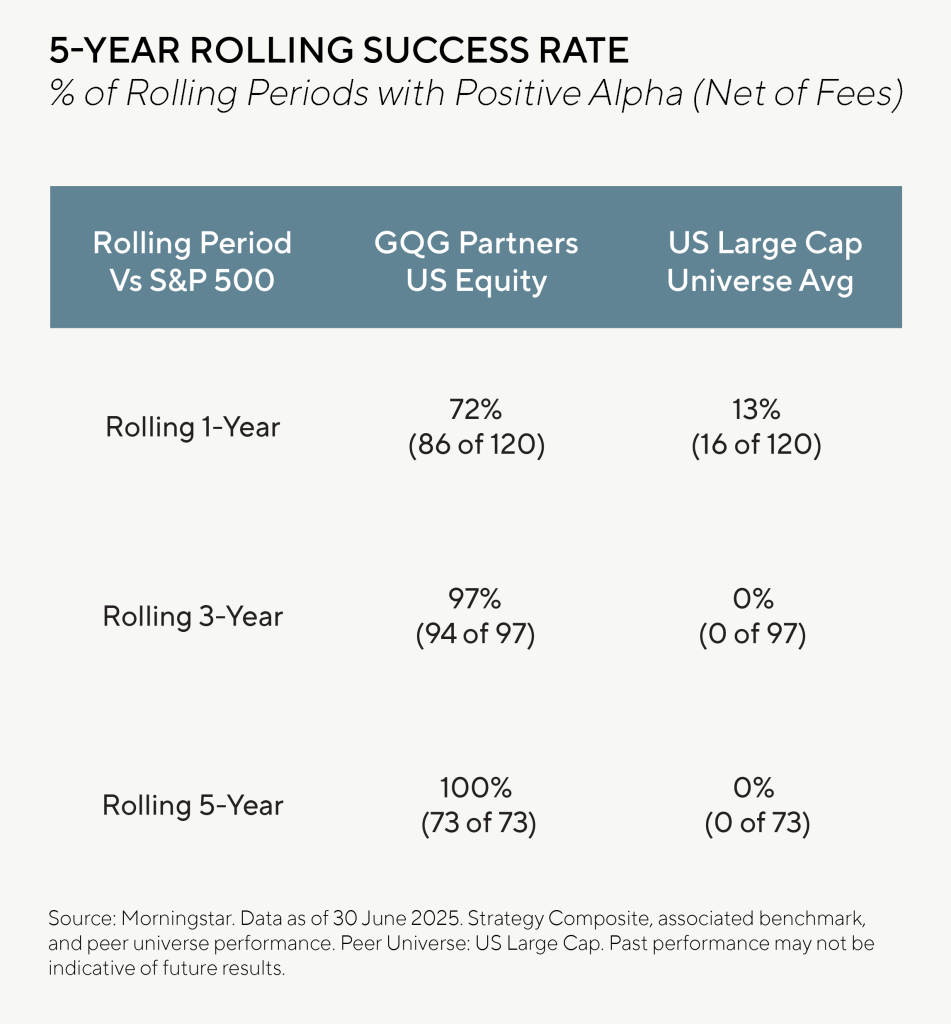

Historical Success Rates calculate the percentage of rolling periods that have achieved positive excess returns versus a benchmark over a stated date range. For example, a 3-year rolling period with a 1-month shift would have 85 individual 3-year periods (each beginning one month after the last) over a 10-year range. If a strategy achieved positive excess returns in 60 of those 85 periods, it would have a historical success rate of 70.59% (60 divided by 85).

INFORMATION ABOUT BENCHMARKS

The S&P 500 Index is a float-adjusted market cap weighted equity index of stocks of 500 leading companies in the United States. The S&P 500 Index is a product of S&P Dow Jones Indices LLC, a division of S&P Global, or its affiliates (SPDJI) and has been licensed for use by GQG Partners LLC. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC, a division of S&P Global (S&P); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (Dow Jones). GQG Partners LLC is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500 Index.

Information about benchmark indices is provided to allow you to compare it to the performance of GQG strategies. Investors often use these well-known and widely recognized indices as one way to gauge the investment performance of an investment manager’s strategy compared to investment sectors that correspond to the strategy. However, GQG’s investment strategies are actively managed and not intended to replicate the performance of the indices: the performance and volatility of GQG’s investment strategies may differ materially from the performance and volatility of their benchmark indices, and their holdings will differ significantly from the securities that comprise the indices. You cannot invest directly in indices, which do not take into account trading commissions and costs. Net total return indices reinvest dividends after the deduction of withholding taxes, using (for international indices) a tax rate applicable to non-resident institutional investors who do not benefit from double taxation treaties.

The US Large Cap peer group is comprised of Morningstar accounts invested primarily in large cap and US companies. Stocks in the top 70% of the capitalization of the US equity market are defined as large cap.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

© 2026 GQG Partners. All Rights Reserved.