Key Takeaways

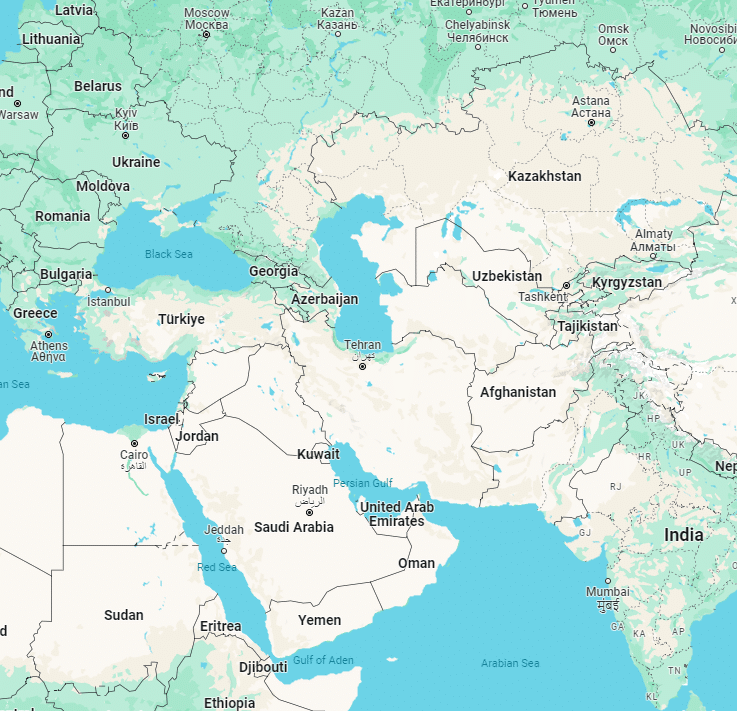

Emerging markets in the Gulf region and Turkey are attracting investors seeking new opportunities beyond the traditional Western economies

The United Arab Emirates and Saudi Arabia are poised to become influential economic centers while Turkey also presents potential due to its strategic location and growing sectors

While these markets are young and still carry risks, particularly from oil price dependency, their growth offers investors the chance for early-mover advantages in broadening their investment portfolios

New York, London, and Hong Kong have been the global financial, trade, and cultural hubs of the last century. That paradigm is widening to now include Abu Dhabi, and Riyadh, as well as Ankara as spheres of influence evolve.

We believe capital markets investors are increasingly looking at once unlikely new territories for the next generation of global investing opportunities since catalysts for growth in most western economies appear to be more limited.

The Gulf countries, once solely reliant on their oil exports for income, are now participating in sectors that were typically dominated by the Global North.

The United Arab Emirates is leading economic diversification by expanding into tourism, trade, real estate, banking, and finance. This process has been hyper-accelerated by a dual-track strategy based on strong property rights, safety and security of assets, and robust human capital due to its multiculturalism.

The New Spheres Of Influence

Turkey and the GCC countries

Saudi Arabia, which has been perceived by the West as one of the most socially conservative countries in the world, is undergoing a social change the pace of which is remarkable. With a young population of 37 million operating in a digitally connected world, the Arab kingdom is increasingly opening its society, fostering entrepreneurship, and diversifying its economy.

These Arab countries, as well as Turkey, possess massive growth potential and have increasingly important roles to play in the geopolitical sphere, in our opinion. Indeed, we believe they have been setting the stage to become the world’s new influential centers of economic and geopolitical gravity. Investors with the foresight and openness towards participating in these countries’ growth potentially have an early-mover advantage.

To be sure, the Gulf region has broadly dollar-pegged economies where fluctuations in oil prices can make or break national coffers. Growth is nascent and markets are young.

In our view, these emerging economies aren’t likely to replace traditional financial hubs but rather broaden the scope of investment opportunities.

MULTILATERALISM PREVAILS

Given current geopolitical challenges—the US and Europe have frozen some national assets, most notably Russia’s—the race is on to explore new areas of relative safety, stability, and potential growth stories outside of traditionally western avenues. In this context, the UAE has been an obvious beneficiary of the global shift towards multilateralism, especially due to its solid financial sector, evidenced by banking assets.1

It’s not surprising that by the end of 2023 a total of 102 asset management firms were operating in Abu Dhabi’s financial center and another 125 firms including hedge funds and asset managers are expected to open their doors this year.2

Saudi Arabia and the UAE are leveraging their location and wealth of resources not only to raise capital, but also to bolster their roles as important partners to global investors and governments alike.

India’s relationship with the Gulf states has evolved from one focused on trade and migration into a more ambitious, strategic, and deeper political, economic, and defense partnership. In fact, UAE and Saudi Arabia are India’s third and fourth largest trading partners behind the US and China.

Turkey is also playing a role as a NATO member, an intermediary in regional conflicts, and gate keeper of the critical Black Sea.

Most recently, amid the unintended economic consequences of Russia’s invasion of Ukraine, Saudi Arabia and UAE have stepped in to ease shortages of energy in Europe and food in Africa. Meanwhile, Turkey plays a balancing act of maintaining relations with both Russia and the West.

On the one hand, Ankara supplies military support to Ukraine and secures Kiev seaborne exports while adeptly blocking Russia from beefing up its Black Sea fleet from outside, or from moving warships in the Black Sea back into the Mediterranean.

On the other hand, Turkey never went along with the West in imposing sanctions on Russia. On the contrary, it’s now the third largest buyer of Russian crude, behind China and India, and has thrown Russia an economic lifeline by being a hub for their oil and gas exports to Europe and beyond.

Cumulative Real GDP Growth

What’s more, a USD $1 trillion economy, Turkey has been growing at a faster pace than the Euro Zone. It’s GDP (on an inflation adjusted basis) will have risen by over 150% through the end of 2028 based off IMF estimates versus where GDP levels stood at the end of the 2000s decade. That compares to the Euro Area which will have grown by a fifth of that amount, or roughly 30%, over the same time period.

In this environment, as the world’s geopolitical and economic order expands from West to East, we believe it’s more important than ever to own equities where the interests of strong corporates and stable public policymakers are aligned.

INVESTMENTS RISE

Both the UAE and Saudi have seen a rise in foreign flows into the financial services sector on the back of heavy investments in technology, tourism, renewable energy, real estate, and infrastructure. The region has also increased investments in private equity and venture capital to help existing local businesses expand in a move towards diversification.

Deals and Capital Deployed in KSA, UAE, Turkey

Source: Morgan Stanley. For the annual time periods ending 2014 through 2023.

Source: Morgan Stanley. For the annual time periods ending 2014 through 2023.

Qatar, one of the world’s three largest liquified natural gas exporters along with the US and Australia, has also been playing a strategic role by offering a lifeline to European and Asian countries that were cut-off from Russia’s gas.

Saudi Arabia’s influence has evolved and strengthened. Once an oil-dependent closed economy, the kingdom embarked on a decades-long reform program starting during the reign of the late King Abdullah. The pace of reform accelerated significantly with the ascent of King Salman to the throne in 2015, the year the country ran a record budget deficit due to a global oil supply glut. Soon after, the nation launched a vigorous and highly ambitious social and economic reform program with a vision not only to wean its dependency from oil exports, but also to transform the Kingdom and to propel it into the future with a renewed sense of self-confidence.

The UAE, with only 1.1 million Emiratis, has benefited from hosting the other 9 million or 88 per cent of its population, the majority from South Asia and having participated in much of the country’s growth. Most recently around half a million Russians have landed in Dubai and Abu Dhabi—especially after that country’s conscription—filling shops, hotels, restaurants and becoming foreign buyers of real estate.

And yet, so far 40 per cent of global emerging market funds don’t have exposure to UAE equities, and half don’t have exposure to Saudi Arabia or to Turkey. These countries have what we consider to be quality businesses at reasonable valuations.

Global Emerging Market funds Positioning

Exposure to KSA, UAE, Turkey

| Country | MSCI EM weight (Dec'23) | Avg GEM Fund Weight | Avg GEM Fund Weight vs Benchmark | % of GEM Funds UW | % GEM Funds Zero Weight | ||||

| Dec'23 | Sep'23 | Dec'23 | Sep'23 | Dec'23 | Sep'23 | Dec'23 | Sep'23 | ||

| Saudi Arabia | 4.17% | 1.63% | 1.78% | -254 | -236 | 86% | 88% | 49% | 48% |

| UAE | 1.26% | 0.45% | 0.80% | -81 | -60 | 69% | 67% | 37% | 40% |

| Qatar | 0.91% | 0.10% | 0.20% | -81 | -72 | 92% | 91% | 78% | 78% |

| Kuwait | 0.75% | 0.03% | 0.06% | -72 | -76 | 98% | 95% | 88% | 86% |

| Egypt | 0.10% | 0.05% | 0.06% | -5 | -4 | 88% | 87% | 84% | 83% |

| S. Africa | 3.07% | 2.73% | 2.62% | -33 | -40 | 59% | 62% | 12% | 5% |

|

S. Africa Exporters |

1.59% | 0.85% | 0.92% | -74 | -66 | 84% | 72% | 33% | 35% |

|

S. Africa Domestics |

1.48% | 1.89% | 1.70% | 41 | 26 | 57% | 48% | 29% | 16% |

| Poland | 0.97% | 0.69% | 0.65% | -29 | -11 | 65% | 66% | 31% | 31% |

| Turkey | 0.61% | 0.38% | 0.42% | -23 | -33 | 69% | 76% | 55% | 62% |

| Greece | 0.48% | 0.58% | 0.42% | 10 | -2 | 67% | 69% | 59% | 59% |

| Hungary | 0.26% | 0.43% | 0.41% | 17 | 17 | 61% | 64% | 55% | 59% |

| Czech Republic | 0.15% | 0.02% | 0.06% | -13 | -10 | 96% | 91% | 94% | 84% |

| EEMEA | 12.74% | 7.10% | 7.47% | -564 | -528 | 90% | 90% | 0% | 0% |

| Middle East | 7.09% | 2.21% | 2.84% | -488 | -444 | 98% | 91% | 31% | 33% |

Source: FactSet and Morgan Stanley Research. Data and benchmark weights as of December 31, 2023.

CONCLUSION

As spheres of influence evolve and the face of global investment shifts at a more rapid pace, we need to keep our eyes wide open to the positive potential and new dynamics in an increasingly relevant part of the investment world.

As investors seeking growth opportunities outside of developed markets, we believe non-traditional emerging economies, such as the UAE, Saudi Arabia, and Turkey, are fertile areas of exploration.

END NOTES

1Jimenea, Adrian and Taqi Mohammad. “Middle East and Africa’s 30 largest banks by assets, 2023”, S&P Global Market Intelligence, April 26, 2023.

2“Abu Dhabi: The Capital of Capital Ends 2023 with ADGM as the Region’s Fastest-Growing IFC”, ADGM, March 6, 2024.

IMORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

INFORMATION ABOUT BENCHMARKS

The MSCI Emerging Markets Index captures large and mid cap representation across 24 Emerging Markets (EM) countries. With 1,376 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

NOTICE TO AUSTRALIA & NEW ZEALAND INVESTORS

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may only be provided to retail and wholesale clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be dis-tributed or passed on, directly or indirectly, to any other class of persons in Australia and New Zealand, or to persons outside of Australia and New Zealand.

NOTICE TO CANADIAN INVESTORS

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation or investment advice. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients in certain Canadian jurisdictions who are eligible “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

NOTICE TO SOUTH AFRICAN INVESTORS

Investors should take cognisance of the fact that there are risks involved in buying or selling any financial product. Past performance of a financial product is not necessarily indicative of future performance. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. The investment value of a financial product is not guaranteed and any Illustrations, forecasts or hypothetical data are not guaranteed, these are provided for illustrative purposes only. This document does not constitute a solicitation, invitation or investment recommendation. Prior to selecting a financial product or fund it is recommended that South Africa based investors seek specialised financial, legal and tax advice. GQG PARTNERS LLC is a licensed financial services provider with the Financial Sector Conduct Authority (FSCA) of the Republic of South Africa, with FSP number 48881.

NOTICE TO UNITED KINGDOM INVESTORS

GQG Partners is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

GQG Partners (UK) Ltd. is a company registered in England and Wales, registered number 1175684. GQG Partners (UK) Ltd. is an appointed representative of Sapia Partners LLP, which is a firm authorised and regulated by the Financial Conduct Authority (“FCA”) (550103).

© 2024 GQG Partners LLC. All rights reserved. This document reflects the views of GQG as of April 2024.

TL SPHS 0424