Key Takeaways

Achieving net-zero greenhouse gas emissions by 2050 may require significant societal behavior changes, including a shift away from continuous economic growth and a reevaluation of consumption habits, particularly in agriculture and meat consumption

While the focus is often on reducing oil and gas production, the second largest source of greenhouse gas emissions is from agriculture, and the meat and dairy products we consume have a direct impact on global warming. Furthermore, our consumption habits, including our digital activities, also contribute to our individual carbon footprints

The current focus on economic growth and the increasing living standards across the globe, coupled with the demand for energy, makes the net-zero goal complex and potentially incompatible, suggesting that significant trade-offs and a more holistic approach may be needed to realistically address climate change

WHAT ELSE IS HOLDING US BACK? CATS, DOGS, AND YES, BEEF

Reducing carbon emissions as quickly as possible across the globe is crucial, in our view. But the belief that we can completely remove the amount of greenhouse gas emissions produced by human activity in less than three decades without major societal behavior changes seems to be questionable – if not a deceiving notion.

Many of the world’s economies have committed to achieving net zero greenhouse gas (GHG) emissions by 2050, or for top emitters such as China and India, targets of 2060 and 2070, respectively. The rallying cry of ‘Net Zero 2050’ has been repeated in board rooms and government departments across the world so often over the past five years that the phrase is now part of the lexicon. While well-intentioned, the commitments and aspirations for a net zero world, in our view, often lack realistic paths.

In fact, it is somewhat concerning to see net zero advocates waging what we consider to be a myopic campaign focused solely on reducing oil and natural gas production without acknowledging this is a broader problem. We believe this requires a much deeper, and often uncomfortable discussion, on whether Net Zero 2050 is compatible with continuous economic growth and the habits of today’s society.

BEYOND FOSSIL FUELS

It is not surprising that the largest single source of GHG emissions from human activities is from the burning of coal, natural gas, and oil for electricity, heat, and transportation. Economic growth and weather patterns affecting heating and cooling needs are the main factors driving the amount of energy consumed.

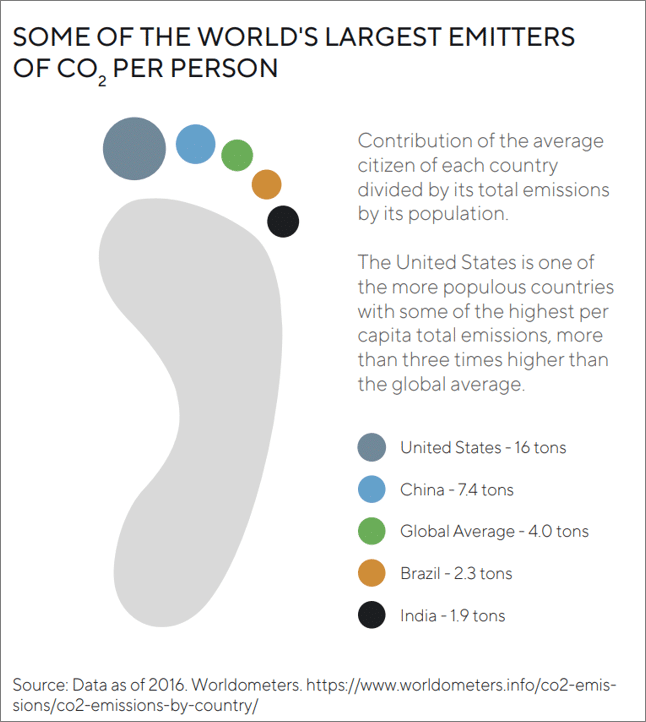

The US is one of the largest GHG emitters as the average carbon footprint for a person living in America is 16 tons per year (or more than three US homes’ electricity use for one year), one of the highest in the world. The EU, which has been one of the most vocal regions in promoting net zero still accounts for 6.8 tons of carbon emissions per person per year. Globally, the average carbon footprint is closer to four tons per person (or less than one home’s electricity use for a year)1 , and to have a chance at reaching net zero, the average global carbon footprint per person per year needs to fall below two tons by 2050.

The US government recently passed the Inflation Reduction Act into law, the first ever to focus on climate change. The legislation provides $370 billion toward decarbonization of the economy by 40 per cent by 2030, but it’s wrapped with compromises and mainly focused on oil and energy. As with other discussions centered around climate change, the legislation does little to address or even bring to light the harsh question: Is Net Zero 2050 possible without a meaningful slow down in global economic growth and changes in other key areas such as agriculture and meat consumption?

“Politicians get very nervous when climate policies are presented in ways in which it would require or maybe even demand individual change,” says James Dyke, Associate Professor in Earth Systems Science, and Assistant Director of the Global Systems Institute at the University of Exeter.3 He continues, “It will not be electoral suicide but it’s going to be very politically unpopular.”

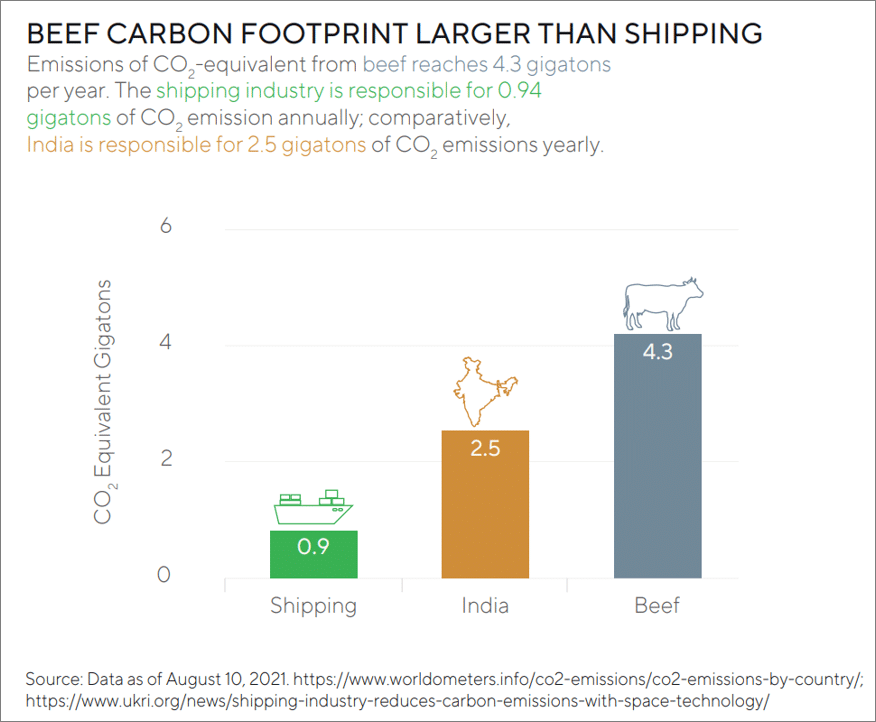

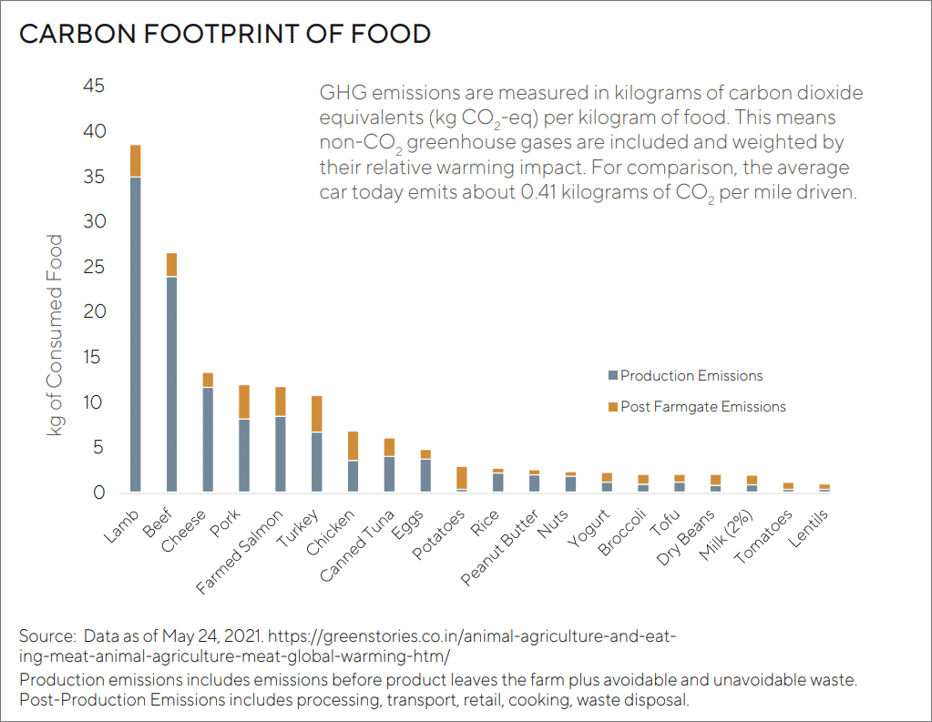

AGRICULTURAL FOOTPRINTS

The second largest source of GHG, methane and nitrous oxide emissions from crops and livestock agriculture, as well as deforestation, is not as widely discussed.4 In short, the meat we eat and milk we drink have a direct effect on global warming. The commentary around net zero often focuses mainly on carbon dioxide. The Intergovernmental Panel on Climate Change counts carbon dioxide emissions as contributing to climate change even though less than half of this gas remains in the atmosphere as a warming gas on an annual basis. That miscalculation means fossil fuels are being blamed for more than their fair share of climate change, while methane is not getting the attention it warrants.

Farmed livestock could account for over half of all human originated GHG emissions per year rather than the 12 per cent previously estimated by the UN Food and Agriculture Organization (FAO), according to one study.5 The discrepancy derives from the Global Warming Potential, a number that allows experts to compare methane with the more well-known carbon dioxide. While CO2 persists in the atmosphere for centuries, or even millennia, methane warms the planet exponentially for a decade or two before decaying into CO2. In those short decades, methane warms the planet by 86 times as much as CO2. But policymakers typically ignore methane’s warming potential over 20 years when assembling a country’s emissions inventory. Instead, they stretch out methane’s warming impacts over a century, which makes the gas appear more benign than it is.6

The livestock industry uses more than 80 per cent of the world’s farmland, either as pasture or as land producing animal feed, yet provides only 18 per cent of global calories.7 Americans alone eat well over 200 pounds of meat each year, and while many other countries eat far less meat, global appetites are catching up quickly, spurred especially by the growing affluence of the rising middle class in Asia and Latin America.

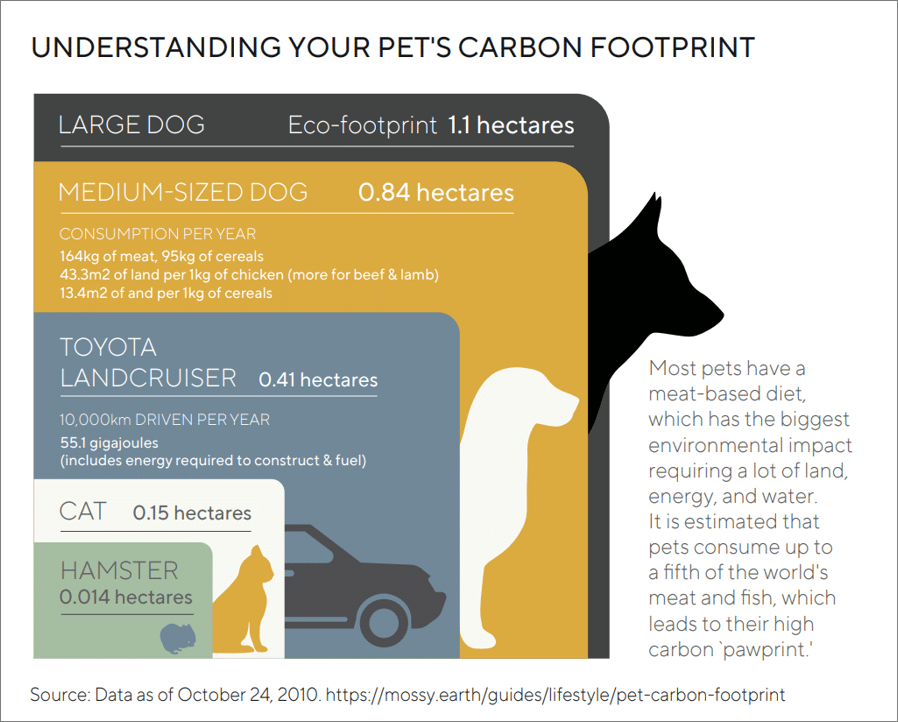

CARBON PAWPRINTS

The food consumption of our own pets also has a significant environmental impact that has been given little attention. The global pet population is estimated to include 900 million dogs and 600 million cats, and a significant portion of their diet is animal products, which makes for a considerable dietary footprint.8

The US has the largest number of pets in the world with more than 163 million dogs and cats consuming more protein from meat and fish than humans do. Europe is not far behind with almost one in two households owning a pet. Germany’s dogs and cats population has reached 27 million, the UK has 24 million and Russia has more than 40 million.9 In the US, the meat eaten by dogs and cats creates the equivalent of 64 million tons of CO2, which has the same climate impact as the annual emission of 13 million cars. Globally, pet food production accounted for GHG emissions of 106 million tons of CO2 equivalent per year. Comparatively, 106 million tons of CO2 would be the equivalent level of emissions produced if every single person in Switzerland, Norway and Denmark drove a gasoline-powered car for one year.10

One may argue that when pets eat the by-products that humans cannot consume, they help keep intensive animal farming operations running. That said, animal-based pet food perpetuates the environmental impact caused by the animal agriculture industry.

CAN PLANT BASED FOOD MAKE A POSITIVE IMPACT?

The plant-based food market has been on the rise for the past few years and is expected to reach $74.2 billion by 2027.11 Plant- and cell-based meat products encompass the flavor, texture, and/or nutritional aspects of meat but are different in composition; namely they are made from non-animal sourced materials. Some plant-based meats are fortified with vitamins and minerals while leaving out unhealthy aspects of animal meat like hormones, cholesterol, and saturated fats. Cell-based meat is made of real animal cells but are grown in a lab where the cluster of cells is placed into a medium that encourages replication and growth, resulting in a mass that resembles hamburger meat or chicken nuggets.

Despite these advances, we think there is little reason for the traditional meat industry to feel threatened as plant-based meats sold in patty, link, and ground form are mostly an add-on to beef and pork, and tend to serve as a substitute for chicken, fish, and turkey.12 And while there is some evidence to support potential benefits of plant- or cell-based meat, we believe the industry needs to evaluate further the impact on humans’ health and the environment.

“The system that we have today is dependent on animal agriculture,” said Dr. Sailesh Rao, Founder and Executive Director of Climate Healers, a non-profit dedicated towards healing the Earth’s climate. “The economic system that we have depends on growth, and to grow the economy governments and industries have to convince people to consume more and more, especially items that require a large footprint, that’s how current economies grow.”

CONSUMPTION TRENDS NOT ALIGNED WITH NET ZERO GOALS

Along with our eating habits, growing consumption is also a topic often ignored in the Net Zero 2050 debate. Consumption, including clothing, household, personal goods, and the use of digital devices account for a significant amount of an individual’s GHG footprint because these items have associated emissions from gathering materials, production, and transport.

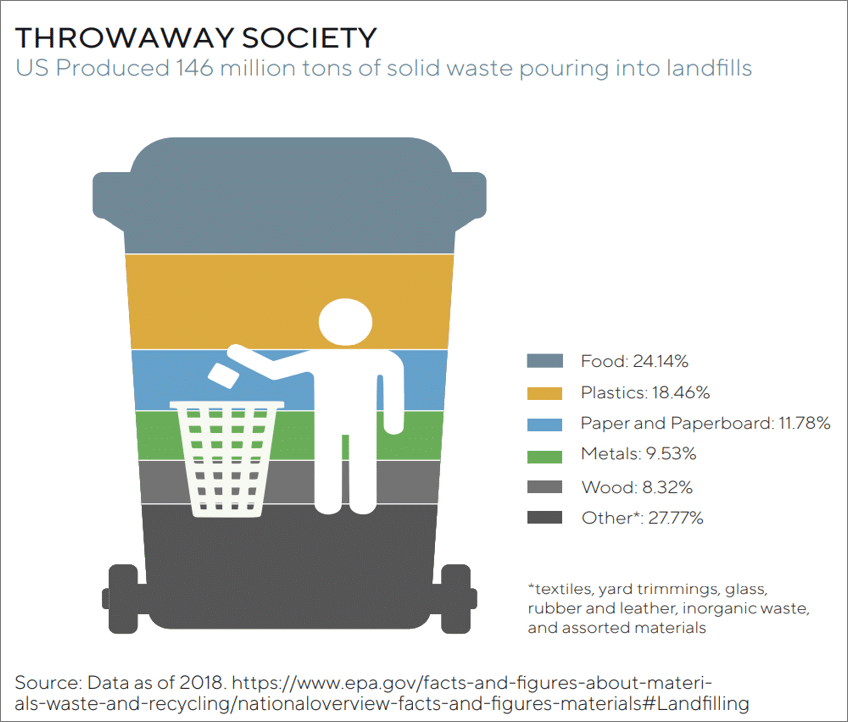

Americans make up just 4 per cent of the world’s population but account for 12 per cent of the planet’s yearly waste, or 4.9 pounds per person per day while Europeans consume in average 3.1 pounds per person per day.13 In 2018, the US produced 146 million tons of solid waste, and food accounted for more than 35 million tons or 24 per cent; plastics accounted for over 18 per cent, and paper and paperboard made up about 12 per cent. American’s garbage production is higher than any other nation in the world per capita. Same goes with clothing. About 85 per cent of our clothing and textiles are disposed of as trash and end up in landfills, while only 15 per cent are donated or recycled.14

Another overlooked part of our daily lives that contributes to increasing CO2 emission is every minute spent browsing the internet, scrolling a social media feed, streaming, or video chatting, as each of these activities add to our digital carbon footprint. Researchers argue that information and communication technology account for 2 per cent of global GHG emissions. New trends in computing and Information and Communication Technology (ICT) such as big data and Artificial Intelligence, the Internet of Things, as well as blockchain and cryptocurrencies, risk driving further substantial growth in ICT’s greenhouse gas footprint.15

Our daily habits and all the conveniences of modern society are part of what makes Net Zero 2050 such a complex issue. Living standards around the world generally continue to increase, which means that people, especially in developed nations, emit a lot more GHG, eat more meat, mostly from factoryfarmed animals, and consume and throw away much more.

In the past 30 years, total transportation emissions have increased due to a rise in demand for both personal and business travel. More families live apart now as compared to decades past demanding increased movement across countries and continents, while business travel makes up a fifth of all the air travel footprint. Heating or cooling our homes, having burgers or hot dogs for dinner, and buying that extra item for our pet, child, or ourselves also accounts for our individual footprint.

Then there is a question of fairness, which is rarely the center of the net zero debate. Large parts of the developing world are either still in poverty or have emerged out of it in the recent past. It’s easy to look through Western world lenses and stand judgement on the desires of these people to have a decent standard of living. But the reality that gets little attention is inequalities in energy consumption is still one of the tragedies of today’s societies, in our opinion.

WHAT LIES AHEAD

Russia’s invasion of Ukraine has triggered a scramble for energy sources in response to sanctions against Russia. This has pushed energy-importing countries to quickly secure whatever forms of power are available, which are mostly greenhouse gas-emitting fossil fuels. Even before the war, there were decarbonization commitments made but little material change to achieve them. Many politicians, industry leaders, and scientists put their faith in technological advancements to reaching net zero.

Even if governments and industries can drive down the costs of capturing and storing carbon dioxide, would it be enough to limit or reduce global warming? Probably not. Many experts agree that actions beyond decarbonizing the electricity supply and transportation systems are necessary if we are serious about limiting warming below 1.5 to 2 degrees Celsius. The problem is not so much that we do not know how to decarbonize, the problem is that we cannot stop extracting fossil fuels because we cannot live without the basic things that result from this extraction.

CONCLUSION: NO EASY ANSWERS

So how much impact can a few countries pressing on this issue have without the full global action and major societal and behavior changes? Is it rational to expect that growing emerging economies that have social and economic goals allocate resources toward reducing GHG emissions when industrialized economies developed using the cheapest form of energy account for far higher emissions than developing nations? How much willingness and effort to slow the pace of global warming is there from warring sides within the same country, let alone from different nations?

There are no easy answers. But if we are serious about addressing climate change, we need a more realistic approach that discusses and tackles key overlooked issues. We need to go beyond the simplistic view of thinking that targeting the oil industry alone will lead the world to net zero emissions and somehow leave global growth, our daily lives, and habits untouched.

Reaching net zero GHG emissions means restructuring the global energy system for all energy uses: power, transportation, manufacturing and industrial operations, residential and commercial buildings, and land use for agriculture, animal agriculture, and forestry. For most of us, it also means changing our eating habits as well as our spending habits. As long as we measure progress based on a country’s entire output of goods and services as a default goal there seems little hope of limiting global warming. To put it simply, continuous economic growth as we know it and net zero goals are incompatible, in our view. If we are serious about net zero, society will need to make significant trade-offs. If this harsh reality continues to be ignored, we run the risk of making Net Zero 2050 an illusion.

END NOTES

1Greenhouse Gas Equivalencies Calculator.

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator#results

2The Nature Conservancy. Calculate Your Carbon Footprint.

3James Dyke. Net-Zero Won’t Save Us. Planet Critical. Oct. 14, 2021.

www.youtube.com/watch?v=TyvFEMw2le8

4US Environmental Protection Agency. Global Emissions by Gas.

https://www.epa.gov/ghgemissions/global-greenhouse-gas-emissions-data

5Robert Goodland and Jeff Anhang. Livestock and Climate Change: What if the key actors in climate change are … cows, pigs, and chickens? World Watch Nov/Dec 2009.

https://awellfedworld.org/wp-content/uploads/Livestock-Climate-Change-Anhang-Goodland.pdf

6Gayathri Vaidyanathan. How Bad of a Greenhouse Gas is Methane? Scientific American. 22 December 2015.

7Andrew Wasley and Alexandra Heal. Revealed: development banks funding industrial livestock farms around the world. The Guardian, 2 July 2020.

8Gregory S Okin. Environmental impacts of food consumption by dogs and cats. Aug. 2, 2017. PLoS ONE 12(8): e0181301.

https://doi.org/10.1371/journal.pone.0181301

9https://europeanpetfood.org/about/statistics/

10https://www.worldometers.info/population/countries-in-europe-by-population/

11Jordan Strickler. Alternative Meats Bringing Uncertain Future For Cattle Farmers. Mar, 8, 2021.

https://www.forbes.com/sites/jordanstrickler/2021/03/08/alternative-meats-bringing-uncertain-future-for-cattle-farmers/?sh=74b52c801b7e

12National Overview: Facts and Figures on Materials, Wastes and Recycling. US EPA.

https://www.epa.gov/facts-and-figures-about-materials-waste-and-recycling/national-overview-facts-and-figures-materials

13Haley Jordan. Keep your clothes out of the Landfill: What to do with Unwanted Clothing and other Textiles. Swagcycle.

14Science Daily. Emissions from computing and ICT could be worse than previously thought. September 10, 2021.

https://www.sciencedaily.com/releases/2021/09/210910121715.htm

IMPORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

NOTICE TO AUSTRALIA & NEW ZEALAND INVESTORS

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may only be provided to retail and wholesale clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be dis-tributed or passed on, directly or indirectly, to any other class of persons in Australia and New Zealand, or to persons outside of Australia and New Zealand.

NOTICE TO CANADIAN INVESTORS

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation or investment advice. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients in certain Canadian jurisdictions who are eligible “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

NOTICE TO UNITED KINGDOM INVESTORS

GQG Partners is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

© 2023 GQG Partners LLC. All rights reserved.

This document reflects the views of GQG as of February 2023.

TLFLI NTZR0123