Fort Lauderdale, Florida — GQG Partners is one of the world’s leading global equity boutique investment management firms with over $90 billion under management. In addition to global equity, the firm offers international equity, emerging markets equity, and US equity strategies across a broad array of investment products and separate accounts.

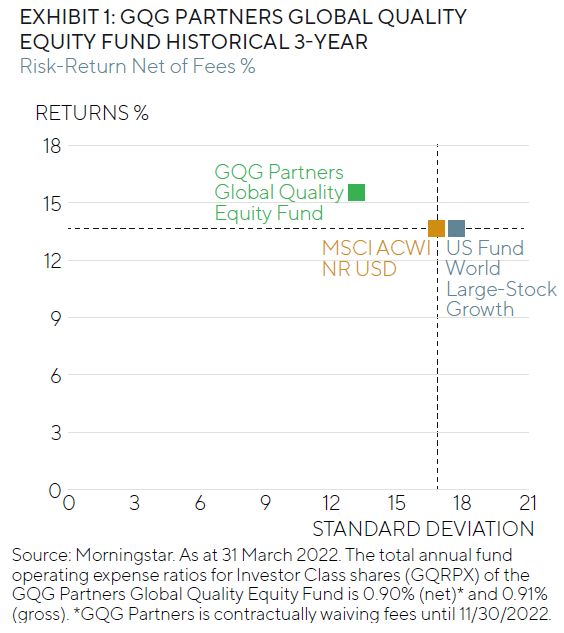

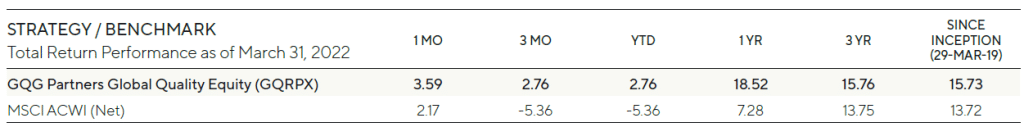

The firm is excited to announce that GQG Partners Global Quality Equity Fund (the “Fund”) is celebrating its 3-year anniversary and the receipt of an Overall Morningstar 4 Star rating. The Fund is rated based on risk-adjusted returns of the investor share class of actively managed funds in the Morningstar US Fund World Large-Stock Growth category (out of 306 funds as of March 31, 2022). The Fund joins other 5-star funds in the GQG line up.

Rajiv Jain, Co-Founder, Chairman, and Chief Investment Officer of GQG Partners and Portfolio Manager of the Fund says: “We are proud of the results we have delivered over the past three years both firmwide and for the GQG Partners Global Quality Equity Fund specifically. It is challenging in any market to provide benchmark beating performance, but we’ve done just that and we continue to remain focused on providing superior risk adjusted returns for our clients.”

The performance data quoted represents past performance. Past performance does not guarantee future results. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling +1 (866) 362-8333. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Returns greater than one year are annualized. Performance may reflect agreements to limit a Fund’s expenses, which would further reduce performance if not in effect. The Fund’s other share classes may have different performance characteristics.

FUND OBJECTIVE

The GQG Partners Global Quality Equity Fund seeks long-term capital appreciation.

Fund Documents »

ABOUT GQG PARTNERS

GQG Partners is an investment boutique which is a wholly owned subsidiary of a majority employee-owned company listed on the Australian Stock Exchange (ASX: GQG). The firm manages global and emerging market equities for institutions, advisors, and individuals worldwide. Headquartered in Fort Lauderdale, Florida, we strive for excellence at all levels of our organization through a commitment to independent thinking, continual growth, cultural integrity, and a deep knowledge of the markets. GQG Partners manages more than US$90 billion in client assets as of March 31, 2022. For more information, please visit gqg.com.

MEDIA CONTACT

Steve Ford, Managing Director — Global Distribution

GQG Partners

+1 (754) 312-6107

sford@gqgpartners.com

UNDERSTANDING INVESTMENT RISK

Investing involves risks, including loss of principal. There is no guarantee the Fund will achieve its stated objective. International investments may involve the risk of capital loss from unfavorable fluctuation in currency values, from differences in generally accepted accounting principles, or social, economic, or political instability in other nations. Emerging markets involve heightened risks related to the same factors, as well as increased volatility and lower trading volume. The Fund is non-diversified. In addition to the normal risks associated with investing, investments in small- and mid-size companies may be more volatile and less liquid than those of large companies. Investments in commodities are subject to higher volatility than more traditional investments. Trading in China through Stock Connect is subject to a number of restrictions that may affect the Fund’s investments and returns, including a daily quota that limits the maximum net purchase under the Stock Connect each day.

You should carefully consider the investment objective, risks, charges, and expenses of the Fund before investing.The Fund’s prospectus and summary prospectus contain this and other important information about the Fund, which can be obtained by dialing +1 (866) 362 8333 or visiting gqgpartners.com. Please read the prospectus carefully before investing. The Fund’s Statement of Additional Information can also be obtained by dialing +1 (866) 362 8333 or visiting gqgpartners.com.

GQG Partners Global Quality Equity Fund is distributed by SEI Investments Distribution Co. (SIDCo), 1 Freedom Valley Drive, Oaks, PA 19456, which is not affiliated with GQG Partners LLC.

IMPORTANT INFORMATION

The MSCI All Country World Index (MSCI ACWI) is a global equity index, which tracks stocks from 23 developed and 24 emerging markets countries. Developed countries include: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland, the UK and the US. Emerging Markets countries include: Brazil, Chile, China, Colombia, Czech Republic, Egypt, Greece, Hungary, India, Indonesia, Korea, Kuwait, Malaysia, Mexico, Peru, Philippines, Poland, Qatar, Saudi Arabia, South Africa, Taiwan, Thailand, Turkey and United Arab Emirates. With 2,939 constituents (as at 31 March 2021), the index covers approximately 85% of the global investable equity opportunity set. Index returns do not reflect management fees, transaction costs, or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary.

GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part II, which is available upon request, for more information about GQG.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

© 2023 GQG Partners LLC. All rights reserved. Data and content presented is as of March 31, 2022 and denominated in US dollars (US$), unless otherwise stated. 3YGQEF 0422PR