Key Takeaways

AI is increasingly being adopted across various sectors and is seen as a crucial area for investment among business leaders to maintain competitiveness

The adoption of AI in business is still in the early stages in our opinion, with expectations that it will follow a typical innovation adoption curve, progressing from current early adopter applications to more widespread use that will fundamentally transform business practices

The potential of AI is grounded in a long history of development, now catalyzed by vast data availability, advanced computing power, and substantial investments, suggesting a significant future impact on the productivity and profitability of industries

Following the buzz created by the launch of ChatGPT, artificial intelligence (AI) has exhibited enormous potential and is becoming more integrated into our daily lives.

The recent unveiling of Sora by OpenAI has sparked a fresh wave of discussion about how AI could change the entertainment industry thanks to the model’s ability to quickly generate high-quality video from text. English Premier League club Liverpool has endorsed a new AI tool from Google DeepMind, relying on geometric deep learning to provide recommendations for corner kicks.1 AI-powered weather forecasting models, such as GraphCast, are now capable of delivering 10-day forecasts with far greater speed and accuracy than previous methods.2 In the pharmaceutical industry, AI is accelerating the drug discovery process by identifying potential compounds, even prompting the FDA to consider a more flexible regulatory framework to accommodate its rapid growth.3

Driving these thrilling developments is a race to invest in AI, spurred by the need to establish a solid infrastructure of foundation capable of supporting the computational power and efficiency necessary for processing complex algorithms and managing large data sets.

Around the world, business leaders are increasingly recognizing the need to craft their own AI strategies to gain an advantage or, at the very least, to avoid falling behind. According to a recent KPMG survey of U.S.-based CEOs leading companies with an annual revenue of at least $500 million, over 72 per cent consider generative AI a “top investment priority,” highlighting the technology’s critical role in future business planning. 4

“Top Investment Priority” – Start with the Foundation

To unlock AI’s potential, businesses will require significant investments in physical, digital, and human capital.

For now, investments are predominantly flowing into the foundational sections of the AI value chain, especially in the development of high-performance chips, semiconductor equipment, and datacenters. As AI models increase in scale, advanced chips are required to process vast amounts of data in parallel at unprecedented speeds, while cutting-edge tools like extreme ultraviolet lithography (EUV) are pushing the boundaries of how many transistors can be fitted onto a single chip. Datacenters, where servers and storage systems are housed, are where the AI magic happens. Together, these components form the backbone that underpins AI capabilities.

At the epicenter of the AI revolution, chip designers are bracing for an influx of investment. Nvidia CEO Jensen Huang projected that global spending on datacenter infrastructure and hardware could reach $2 trillion within the next four to five years.5

The ambitious pitch has turned heads across the market, capturing widespread interest and speculation. Considering other server content, networking equipment, buildings, power, and cooling systems that are required for AI chips to operate, it suggests that hyperscalers and tier-2 datacenter players would have to spend several times the total spend in previous years. We believe Wafer fab equipment (WFE) manufacturers are also poised to benefit from the investment flows in leading edge tools. As demand for AI chips escalates, these producers of the machinery essential for chip manufacturing are anticipated to experience a surge in business.

To be sure, this infrastructure is just the starting point for the AI technology stack. Across the tech landscape, there is a flurry of activity at every layer of AI development including data management, algorithms, real-time monitoring, application-specific refinement, and governance. Big Tech behemoths, as well as startups–often fueled by venture capital–are making rapid progress in these fields.

What Lies Ahead?

While the enthusiasm for AI is clear, and companies are making it an investment priority, business leaders recognize that it might take some time before their investments pay off, suggesting that we are still in the early phase of adopting this technology. According to the survey conducted by KPMG, more than half of the CEOs think they will start seeing profits from their AI investments in three to five years.4

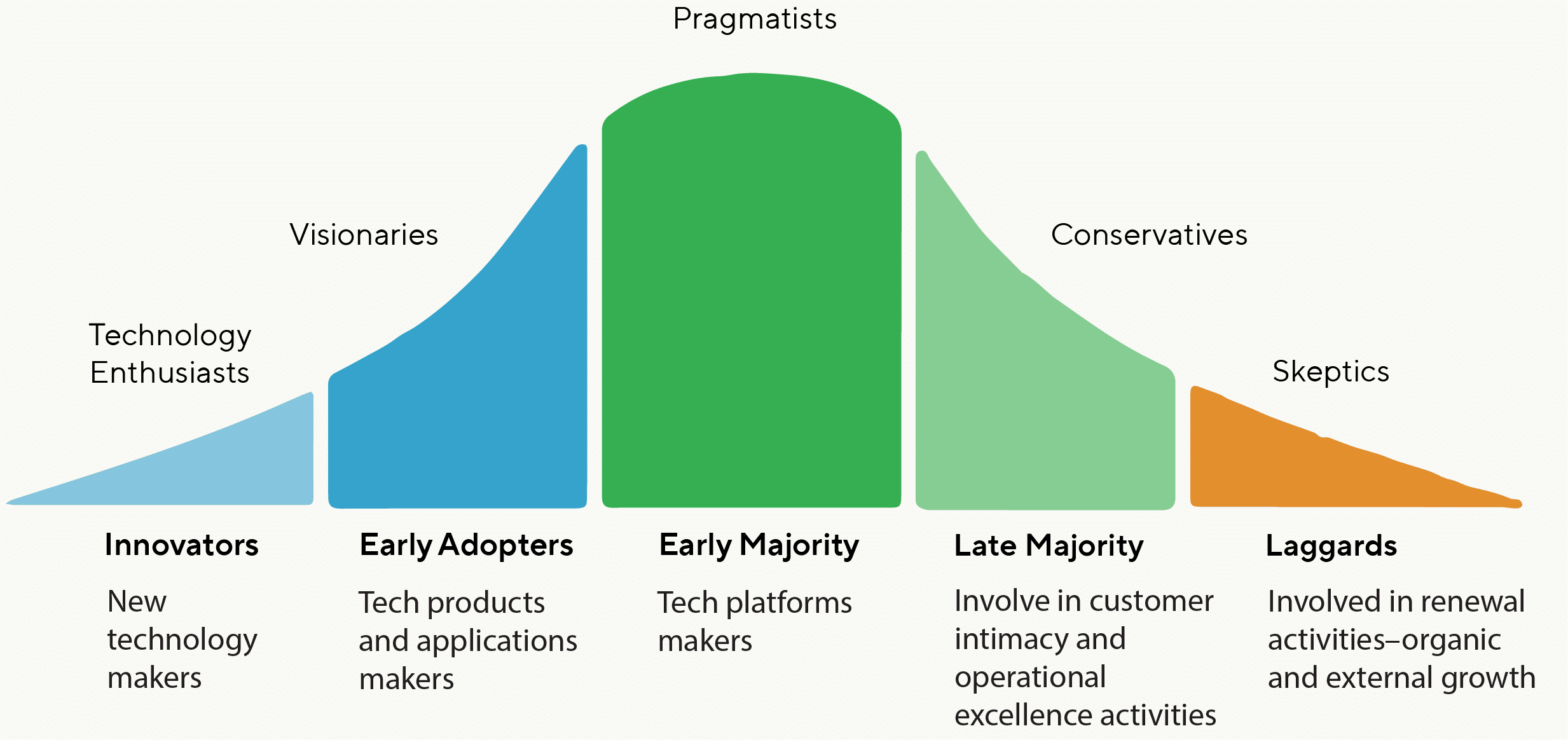

AI adoption may follow the typical trajectory of the “Innovation-Adoption Curve,” a model created in 1962 by Ohio State professor Everett Rogers as a method of explaining how, why, and the rate at which an innovation spreads through a population or social system. According to Professor Rogers, a typical adoption process goes through five stages: innovators, early adopters, early majority, late majority, and laggards.

Roger’s Innovation Adoption Curve

Current Gyrations are Heralding Transformative Potentials

Source: Grow Enterprise

Based on the curve, we believe we are still at the nascent stage of “early adopters,” evidenced by the direct applications of large language models (LLMs), such as ChatGPT and tools like GitHub Copilot–often without much product innovation.

At present, Microsoft’s GitHub Copilot stands as one of the most successful enterprise applications of generative AI. Powered by a language model trained on a large corpus of code from publicly available sources, including code on GitHub itself, Copilot can help developers complete their codes by suggesting entire lines or blocks of code as they type, significantly improving productivity and potentially reducing coding errors.

In the digital advertising space, Internet giants are starting to reap the rewards of AI investment. Google reported that its advertisers already started seeing higher conversion rates. Meta, the parent company of Facebook, WhatsApp, and Instagram, has leveraged AI tools for content creation and placement to provide more personalized experiences and boost user engagement.

Experts say that before moving onto the next stage–“early majority”-enterprises will increasingly focus on measuring the effectiveness and financial impact of their AI initiatives, evaluating the return on investment (ROI) they deliver. At this stage, enterprises are more likely to optimize internal workflows to boost organizational ROI before they go back and refine their models for more specific use cases, including consumer products.

In three to five years’ time, AI applications are expected to enter the stages of “late majority” or “laggards,” when some out-of-the-box solutions will emerge and fundamentally change ways of conducting business. Although it is too early for us to pinpoint what these innovations will be, they are likely to represent the next frontier of AI application in enterprise settings.

A Promising Trajectory

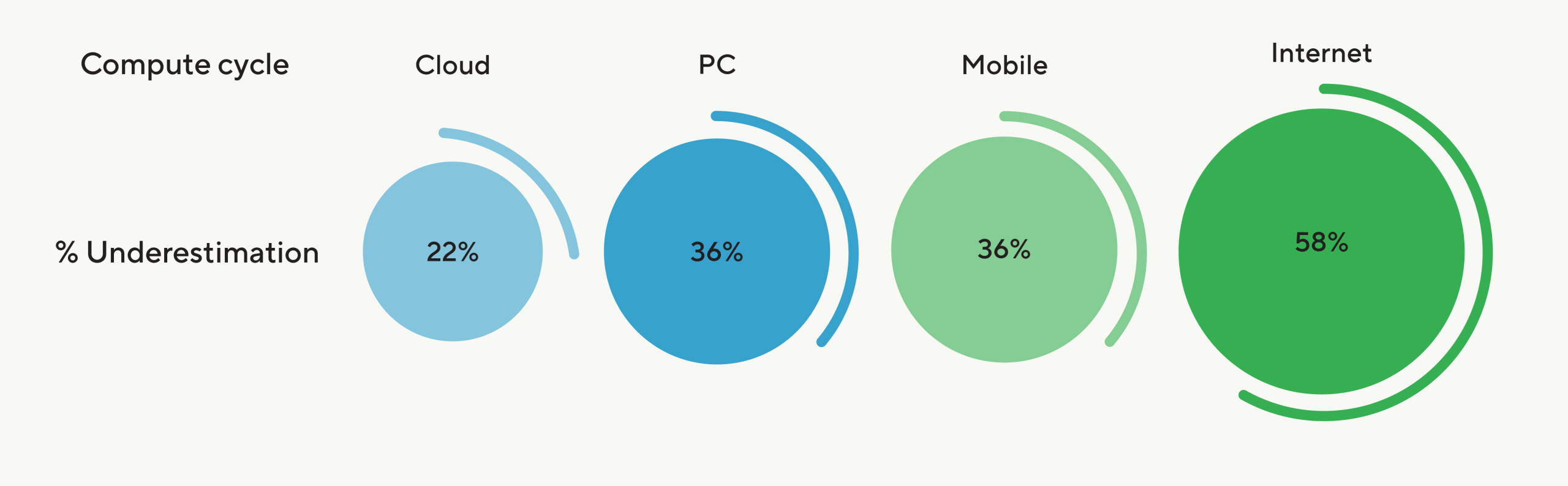

Even with the growing investments, AI’s impact on overall IT budgets appears to be modest at present.6 The cautious approach observed in budgets echoes a familiar historical narrative. Throughout time, revolutionary technologies often faced initial skepticism and underestimation. Take the Internet, which in its early days was dismissed by many as a fad or niche tool. Today, it is ingrained in every facet of our lives. Similarly, the iPhone was initially met with resistance but ended up redefining entire sectors, including mobile computing and photography.

Generative AI Remains Top of Mind

To be sure, not every emerging technology thrives; some do fall short of expectations. However, the key takeaway is that underestimating the transformative power of a technology in its early stages is a recurring theme in history, often proven wrong by the tide of progress.

A History of Underestimation

Wall Street Failed to Foresee the Potential for Previous Transformative Technologies

Source: Hugging Face, Morgan Stanley Research. Underestimating Innovation.

Nevertheless, several distinct factors are forging a promising trajectory for the broad adoption of AI across a range of industries, in our opinion.

AI stands out as an investment theme with unanimous support among major players – a contrast to previous emerging technologies which elicited varied responses, such as the Metaverse, or were championed by solitary trailblazers, like SpaceX. Leading technology companies–normally fierce rivals –have formed alliances such as the Partnership on AI, highlighting a united dedication to responsible development. By combining diverse perspectives and resources, these companies are likely to advance the technology faster by addressing complex regulatory challenges collaboratively. Thanks to the transformative nature of AI, Big Tech companies are also working together to request regulatory frameworks and address concerns from governments.

The number of AI models on Hugging Face, a platform allowing users to download datasets for model fine-tuning, has been increasing exponentially, up 352% year-over-year to nearly 500,000 as of early 2024. Meanwhile, the mix of the AI models has also broadened rapidly.

Breadth of Application is Expanding Rapidly

Success Dependent on Long-Term Operational Outcomes

The Seeds of Intelligence

While often portrayed as a recent phenomenon, AI boasts a rich history, tracing back to the 1940s when Alan Turing, a British mathematician, laid the groundwork with his “Computing Machinery and Intelligence” paper that proposed the Turing Test–a measure of a machine’s ability to exhibit intelligent behavior equivalent to, or indistinguishable from, that of a human.

Shortly after, in 1955, John McCarthy coined the term “artificial intelligence” at the Dartmouth Workshop, igniting a collective effort to explore the possibilities of creating machines that could think and learn. Over the coming decades, researchers demonstrated AI’s potential through a series of early breakthroughs.

These successes fueled optimism, but limitations in computing power hampered development and wide-spread adoption of AI. By the early 2010s, a turning point arrived as three key factors converged, propelling AI from a niche academic pursuit to corporate reality:

AI’s early breakthroughs

—The Perceptron (1958): Simple artificial neural network that could learn to classify patterns. Developed by Frank Rosenblatt.

—Prolog (1972):Programming language based on logic used to develop natural language processing systems. Developed by Alain Colmerauer.

—Deep Blue (1997): Chess computer that defeated Garry Kasparov, the then-world chess champion. Developed by IBM.

From Academic Concept to Corporate Reality

AI Revolution Ignited by Data Boom, Computing Advances, and Capital Infusion

Data Deluge

The digital age witnessed an unprecedented explosion of data. From social media interactions to scientific datasets, information was generated and stored in enormous amounts. This data was not just vast; it was diverse, complex, and often unstructured, representing the messy reality of the world we live in. This data became the lifeblood for training AI models, providing them with the raw material needed to learn and evolve.

Power Surge

Moore’s Law, the exponential growth of computing power, finally caught up with AI’s demands as the number of transistors surged. For background, transistors are the electronic switches on a semiconductor that power the chip and enable performance.

Capital Resources

Unlike cash-strapped startups of the past, the companies leading the AI charge today have scalable infrastructure given their cloud platforms and the financial resources from high cash flowing business models that are funding CapEx needs. Combined, the largest six cloud companies spent $160 billions on CapEx in 2023, representing 0.6 per cent of the US GDP.

Source: Large Tech CapEx: Bloomberg, Company Filings. Global Data Generated Annually: Data Sources. Moore’s Law: Transistor Count

The AI Road Ahead

Early versions of AI were typically confined to specialized applications, such as image recognition or board games, due to constraints in data and resources. Today, AI is infiltrating a variety of industries, including healthcare for drug discovery, finance for fraud detection, and manufacturing for warehouse automation. We expect new uses to emerge on a regular basis as AI models grow larger, as well as more sophisticated, and humans learn how to deploy them in an optimal manner.

We believe the implementation of AI models across the corporate landscape is likely to impact the earnings power of many companies across a wide variety of industries during the next few years. This impact will be positive for certain businesses and negative for others, in our opinion.

We are excited to monitor the evolution of the technology and adapt the positioning of our portfolios as we get more visibility on who we think the likely winners and losers will be.

END NOTES

1 Wang, Zhe and Veličković ,Petar. “Tactical AI: an AI assistant for football tactics”, Google DeepMind Blog, March 19, 2024.

2Lam, Remi. “GraphCast: AI model for faster and more accurate global weather forecasting”, Google DeepMind Blog, November 14, 2023.

3“Artificial Intelligence and Machine Learning (AI/ML) for Drug Development”, .S. Food & Drug Administration, March 18, 2024.

4“KPMG 2023 U.S. CEO Outlook”, KPMG LLP, October 5, 2023.

5Moss, Sebastian. “Nvidia CEO Jensen Huang predicts data center spend will double to $2 trillion”, Data Center Dynamics. February 14, 2024.

6Roser, Max. “Artificial intelligence has advanced despite having few resources dedicated to its development – now investments have increased substantially”, Our World in Data, March 29, 2023.

IMORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

NOTICE TO AUSTRALIA & NEW ZEALAND INVESTORS

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may only be provided to retail and wholesale clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be dis-tributed or passed on, directly or indirectly, to any other class of persons in Australia and New Zealand, or to persons outside of Australia and New Zealand.

NOTICE TO CANADIAN INVESTORS

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation or investment advice. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients in certain Canadian jurisdictions who are eligible “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

NOTICE TO SOUTH AFRICAN INVESTORS

Investors should take cognisance of the fact that there are risks involved in buying or selling any financial product. Past performance of a financial product is not necessarily indicative of future performance. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. The investment value of a financial product is not guaranteed and any Illustrations, forecasts or hypothetical data are not guaranteed, these are provided for illustrative purposes only. This document does not constitute a solicitation, invitation or investment recommendation. Prior to selecting a financial product or fund it is recommended that South Africa based investors seek specialised financial, legal and tax advice. GQG PARTNERS LLC is a licensed financial services provider with the Financial Sector Conduct Authority (FSCA) of the Republic of South Africa, with FSP number 48881.

NOTICE TO UNITED KINGDOM INVESTORS

GQG Partners is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

GQG Partners (UK) Ltd. is a company registered in England and Wales, registered number 1175684. GQG Partners (UK) Ltd. is an appointed representative of Sapia Partners LLP, which is a firm authorised and regulated by the Financial Conduct Authority (“FCA”) (550103).

© 2024 GQG Partners LLC. All rights reserved. This document reflects the views of GQG as of June 2024.

TL DCDAI 0624