Key Takeaways

The US power grid is facing the need for unprecedented levels of investment to accommodate growing demand for electricity and facilitate the transition to other power sources

A significant bottleneck to the energy transition is the lengthy and uncertain project permitting process, which can be exacerbated by opposition from existing power generators

The modernization of the grid has also been delayed due to shortages of specialized labor, such as lineworkers, and raw materials, like transformers and steel

The upgrade and expansion of the US power grid is the biggest bottleneck and the biggest threat to the energy transition, in our opinion. US electricity demand is expected to grow significantly in the coming years on the back of manufacturing reshoring as well as new data centers, electric vehicles, and building electrification. Grid interconnection, be it transmission or distribution, is aging, requiring upgrades or replacement. Proposed energy projects are mired in lengthy and uncertain permitting processes that are backlogged for years and sometimes ultimately cancelled. Specialized labor, which is currently in short supply, will need to grow by at least 50 percent to meet future grid investment needs.1

Electric Grid Infrastructure

Significantly larger investments will have to be made in the power grid to support the rollout of 3x the amount of renewables needed to replace fossil fuel generation. This could amount to an increase in investment of 5x to 10x historical levels, as not only is there a need for more capacity, but also the majority of the grid is near the end of its useful life.1 Utilities are also shifting existing power lines underground to reduce damage, which would require additional capital expenditures.

US annual transmission and distribution spend is expected to rise 25 percent from $78 billion today to $98 billion by 2050, and of all incremental grid spend through 2050, around 70 percent of that is expected to happen at the distribution level.2

To bring the US to meet the demand and service the electricity supply bottlenecks, the US will need 47,300 GW-miles of new transmission by 2035, a 57 percent increase compared to today’s transmission system, according to the Department of Energy (DoE). “It takes an average of 3 years to construct new facilities. The lead times on major electrical equipment are months long,” said former infrastructure planning executive at PJM Interconnection, part of the Eastern Interconnections.

Transformers are the biggest and most expensive system in the substation. Over 90 percent of the electricity consumed in the US passes through large power transformers, making them the backbone of the nation’s high voltage bulk-power system. There is a multi-decade replacement program underway in the US as installed transformers pass their 35-year life span. Lead times for large transformers have increased to 120 weeks on average this year.3

The bottleneck is due to short supply of grain-oriented electrical steel (GOES), a material critical to the performance of transformers. Commodity prices for GOES have doubled since January 2020, while copper prices have increased approximately 50 percent over the same time frame. Prices have eased but are expected to be volatile going forward due to capacity constraints and growing demand.

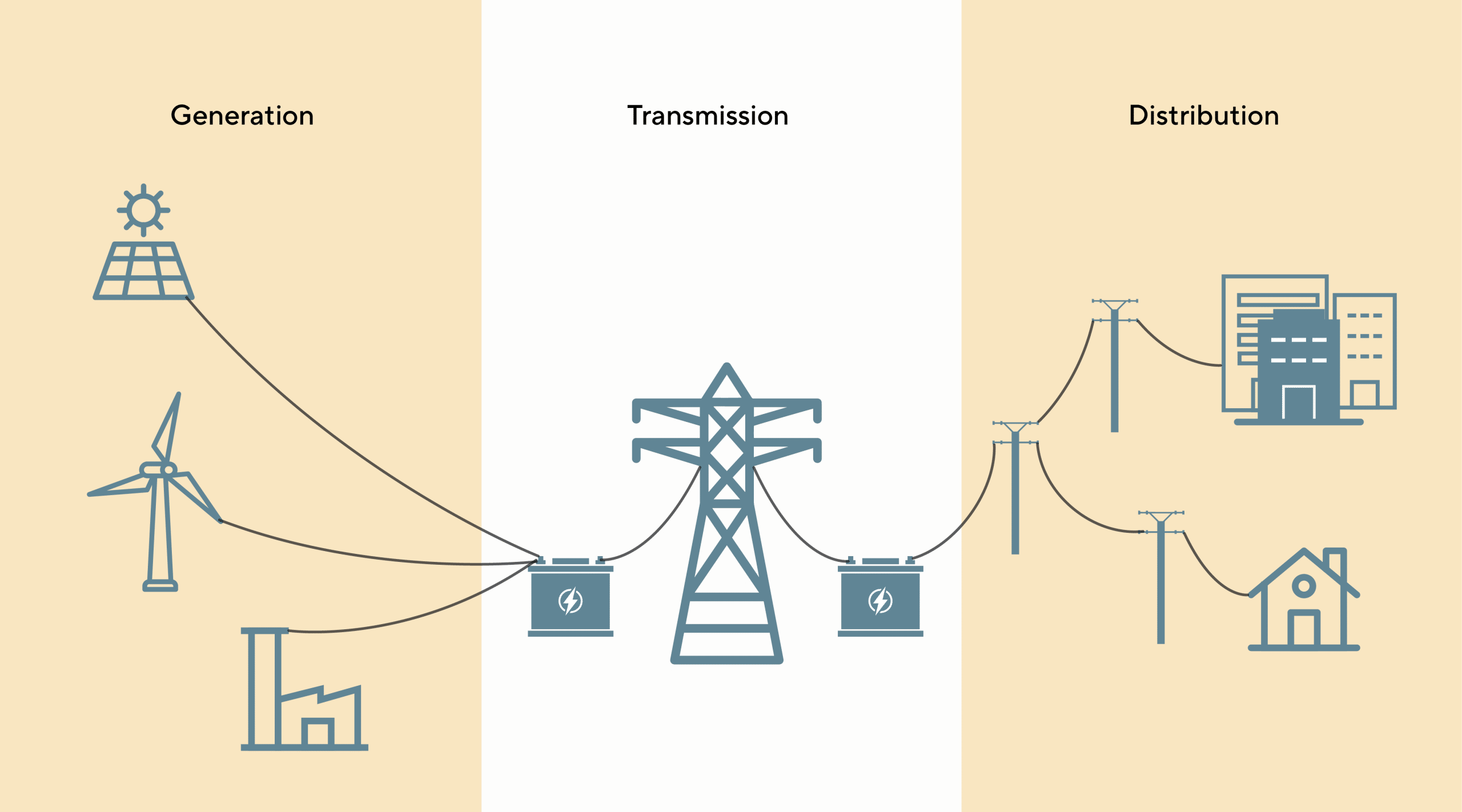

Electric Power Sector Systems

Source: GQG Partners. CRS, adapted from U.S.-Canada Power System Outage Task Force.

Permitting

Currently there are an estimated 10,000 renewable energy projects, representing nearly 2.6 Terawatts of power, seeking permission to connect to the grid, twice the number from two years back. It takes five years for the typical power plant to get approval, twice the time it did a decade ago. The surge in new power generation capacity is due to federal tax incentives, including the Inflation Reduction Act (IRA), state clean energy policies, and corporate demand for renewable power sources. In fact, renewables accounted for over 95 percent of all incremental capacity by the end of 2023.4

Installed US Electric Generating Capacity vs Interconnection Queue Capacity

The Federal Energy Regulatory Commission (FERC) has started to streamline the approval process by ordering grid managers to study projects in bundles and prioritize those that are closest to construction, but an overlooked issue is the opposition by power generation businesses.

“If you look carefully in some of the dockets of various public utility commissions around the country, you will find that sometimes whenever a new utility line is being proposed, generators will often officially become party to the case in order to oppose the transmission line,” said a former chairman of a US public utility commission.

“They’ll come up with some reason like it’s unneeded, it’s a waste of taxpayer money, it’s unreasonable seizure of private land, but the reality is they don’t want more supply to get to the market because they have that part of the market cornered. That’s another conflict that is hiding just beneath the surface.”

To substantially increase renewables, we believe regulations around land access will need to be updated—especially around densely populated areas—to provide the land required for renewables. Yet many of the property owners of those areas do not want high-powered transmission lines, wind turbines, or solar panels in their back yards. Solar requires roughly 10 to 20 times more land than gas, and onshore wind up to 200 times more, to generate the same amount of electricity.5

In addition, a web of factors such as access to electric transmission, conflicts over competing land use, and environmental degradation must be navigated through multiple federal, state, and local regulatory permitting processes.

Labor Shortages

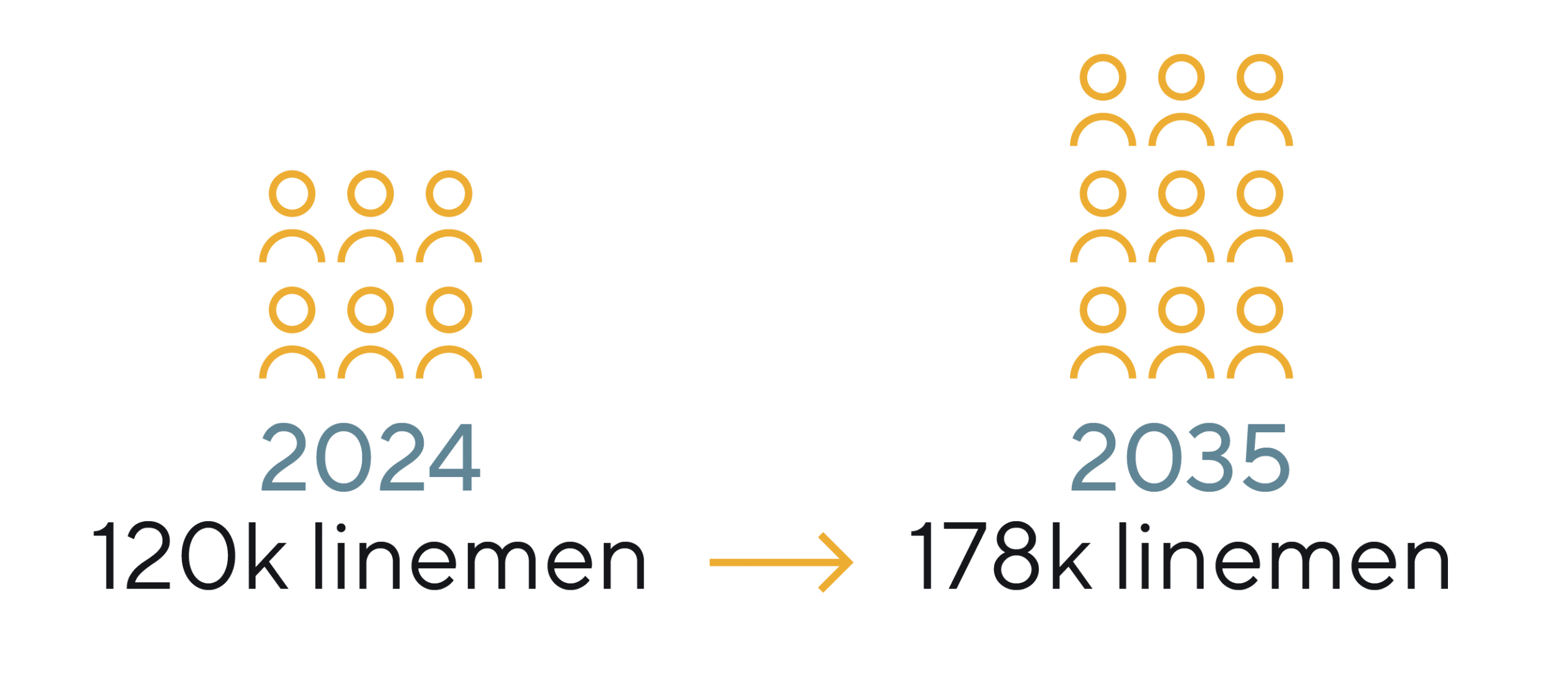

There are currently 120,000 linemen working in the US grid. However, to modernize and expand the grid, it is estimated that the industry will need at least 178,000 linemen by 2035, or a 50 percent increase. Sourcing this labor is challenging because they are skilled craftsmen with at least five years of training and experience needed.6

Electrical Lineman Shortage