Key Takeaways

Carbon capture and sequestration (CCS) is emerging as a crucial tool in mitigating climate change, offering both a solution to emissions reduction and a new business model for companies in the form of low-carbon fuels, CO2 feedstocks, and sequestration credits

Integrated oil companies (IOCs), particularly ExxonMobil and Occidental Petroleum, are leading in CCS efforts, leveraging their existing infrastructure and expertise to capture and store more carbon than other oil majors

Government support, such as tax credits and infrastructure investment, is boosting the viability and profitability of CCS, positioning it as a promising investment opportunity and a key component of the global energy transition

Nuanced Issues Call for Novel Solutions

Amid ongoing efforts to meet the targets of the Paris Agreement and limit the global temperature rise to 2°C by 2050, both governments and industries face a tough challenge: addressing emissions mitigation while accounting for the increased demand for fossil fuels. In our view, carbon capture will be an important comparative advantage as governments, investors, and other stakeholders look for leaders in climate change mitigation.

While investment in carbon capture has largely been viewed as a moral quandary rather than an investment opportunity, the dynamics are changing. In fact, carbon capture has acted as a hedge to stranded asset risk for years, and now provides a new model for revenue growth in the form of low-carbon fuels and chemicals, CO2 based feedstocks, and sequestration credits.

As it stands, we believe developed-market upstream producers are in the best position to take advantage of carbon capture and sequestration (CCS) and contribute to the global energy transition. Let’s delve deeper into the carbon capture efforts of integrated oil companies (IOCs), specifically ExxonMobil (XOM) and Occidental Petroleum (OXY), which are leaders in the space despite criticism that they are not doing enough to reduce their emissions.

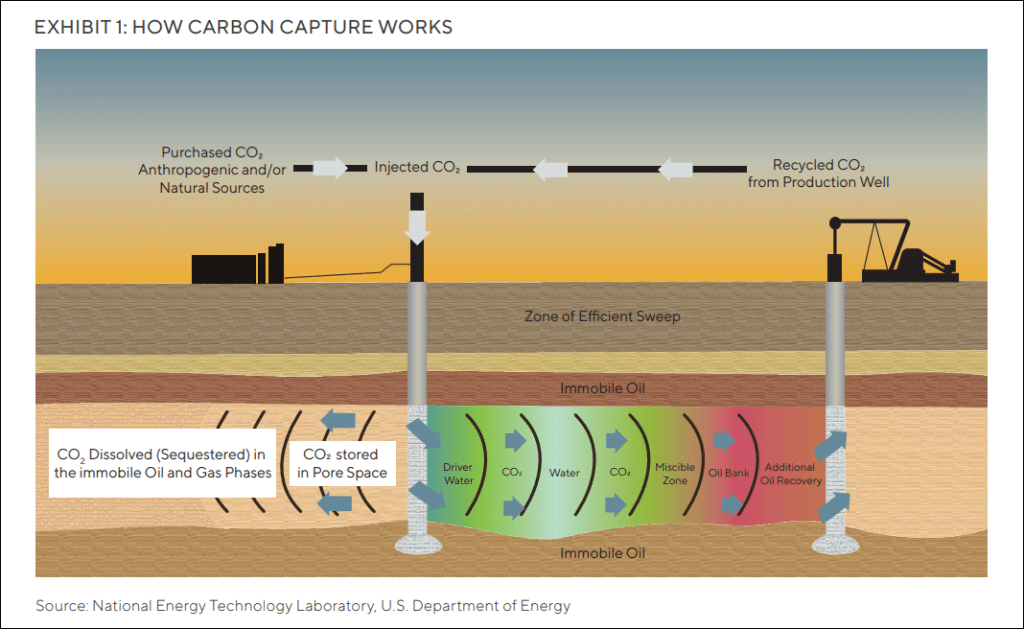

CARBON CAPTURE: MIT CLIMATE PORTAL

Carbon capture technology was patented in 1952 by the Atlantic Refining Company and became commercialized in the 1970s with a process known as enhanced oil recovery (EOR). The EOR process involves the injection and recycling of CO2 from a point-source through a reservoir to recover oil when conventional drilling is no longer viable. Today, this process is used to produce what the industry refers to as “low” or “zero-carbon” fuel, as the captured CO2 is recycled through a closedloop system and, at times, partially stored in subsurface reservoirs.

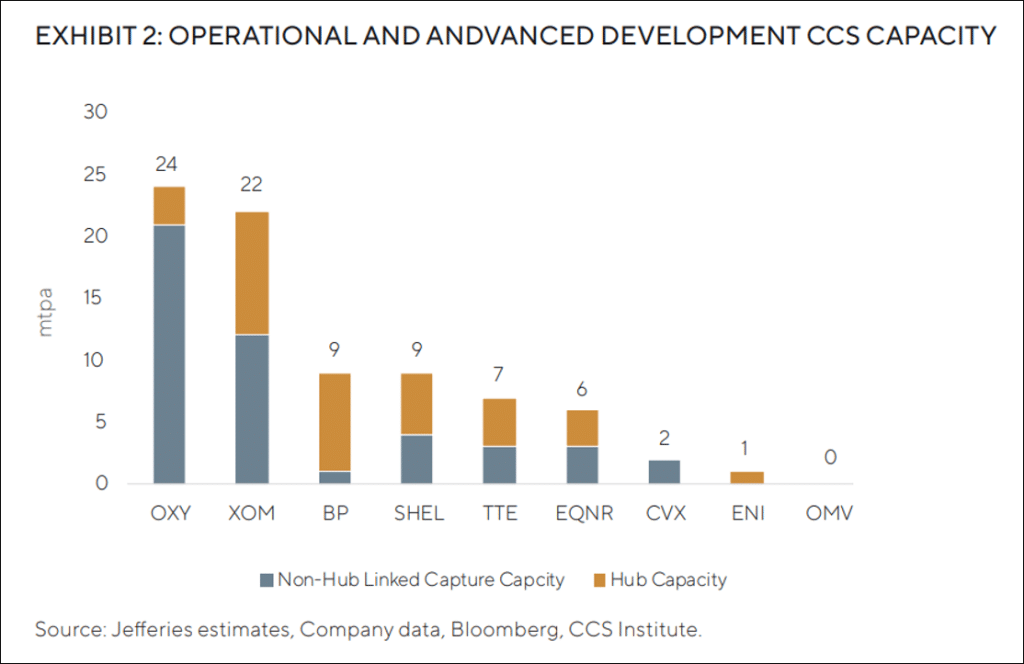

CCS consists of three main components that are also utilized in the EOR process: capture, transportation, and storage of CO2. Since carbon capture for EOR was first utilized in the Permian Basin in West Texas, traditionally US based oil majors have had an advantage in the development and expansion of this technology. Companies like Occidental and ExxonMobil now operate some of the largest EOR projects globally and maintain the infrastructure of pipelines needed to transport and store carbon. As a result, Occidental and ExxonMobil capture more carbon than any other oil majors, as noted in the chart below.

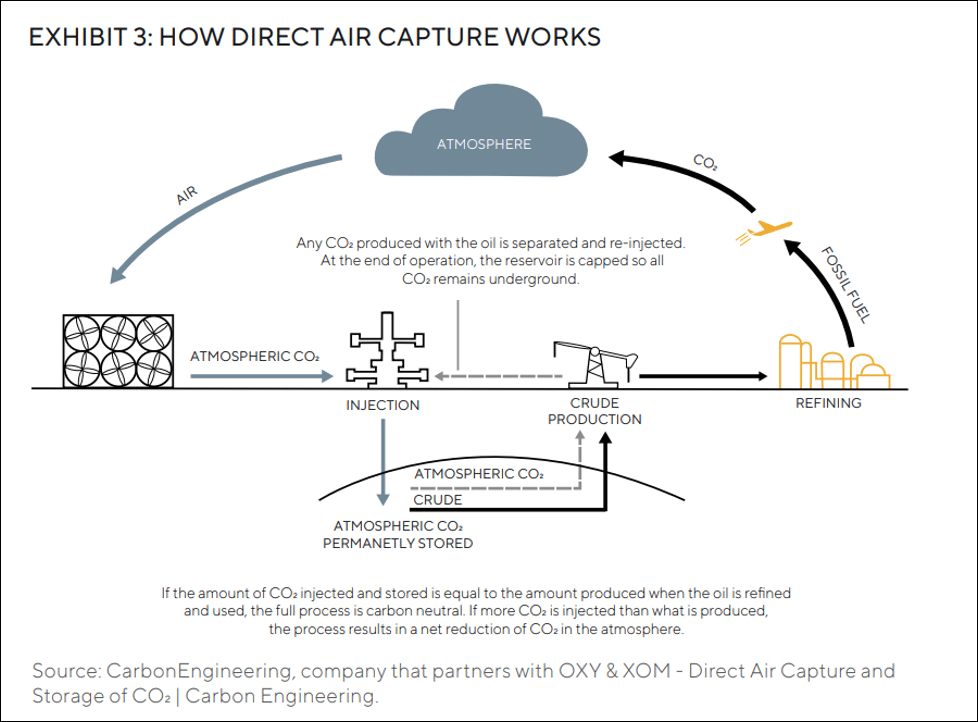

AN ALTERNATIVE – DIRECT AIR CAPTURE

Another CCS solution being explored by Occidental and ExxonMobil is that of direct air capture (DAC), which is technologically mature and reaching commercial viability. DAC technologies remove CO2 from the air through the use of chemical sorbents or solvents.

Solvent plants use liquid solvent to separate and absorb CO2 as air passes through the system, resulting in the formation of a stable solid mineral (CO2 and Ca).1,2

Heat is then used to re-gasify the CO2 for EOR or sequestration. Sorbent plants use solid sorbent as a filter to bind with the captured CO2 and then apply low-temperature heat to release the CO2.1,2

When compared to pointsource capture, DAC is more energy intensive and expensive as atmospheric CO2 is less concentrated than flue gas from a power station or a cement plant. This leads to higher energy demand and costs relative to other CO2 capture technologies and applications. However, the deployment of DAC plants will be key to reducing absolute global emissions.

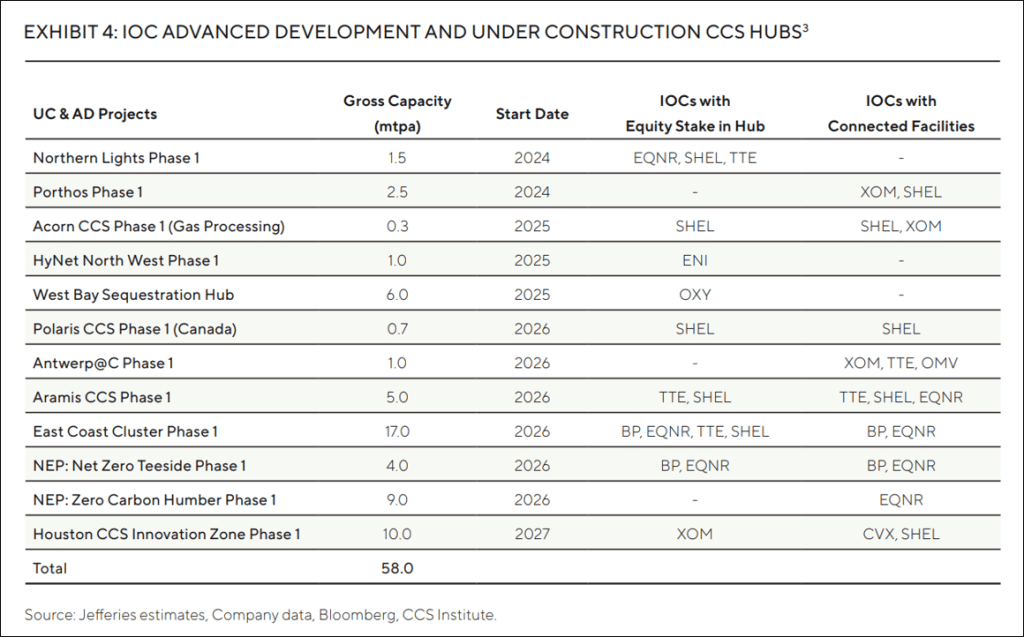

SEQUESTRATION HUBS

The development of sequestration hubs, which aggregate emissions from multiple sources, is a major opportunity for IOCs. It is the most efficient way to decarbonize industrial clusters and achieve economies of scale. Shared storage sites also reduce the costs of drilling wells, managing injections, and monitoring sites for leakage. By minimizing transport and storage costs through the use of hub projects, we believe CCS can become more viable. ExxonMobil is leading the charge in hub capacity, with its Houston Hub projected to capture and store ~50 million tons per annum (mtpa) of CO2 by 2030. This project is a collaboration between ExxonMobil, Chevron, Dow, Linde, Valero, and other industrial and chemical companies.

CAPACITY AND GROWTH

Based on the sixth assessment report by the Intergovernmental Panel on Climate Change (IPCC AR6), achieving net zero by 2050 requires the capture of ~10 gigatons (GT) of CO2per year, which represents nearly a quarter of global annual emissions. Current global capture capacity stands at 44 mtpa4 – the equivalent of emissions from over 8 million passenger cars.5 Although the world is far short of capturing 10 GT annually, in 2022 alone, the total capture capacity of commercial CCS projects (operational and in-development) grew to 244 mtpa6 – a 44 per cent increase year-over-year.

We learned through one of our engagements with Occidental that the total cost of a DAC plant stands at ~$1.4 billion, of which Occidental will contribute $275 million for its first DAC plant. Although guidance on further allocations towards direct air capture has not been disclosed, the company recently outlined its ambition to have 100 DAC plants online by 2035 and will invest between $100 million and $500 million in its low carbon ventures segment. Occidental was also confident that its Low Carbon Ventures unit will eventually eclipse OxyChem sales, which represented ~19 per cent of Occidental’s total revenue in 2022.”

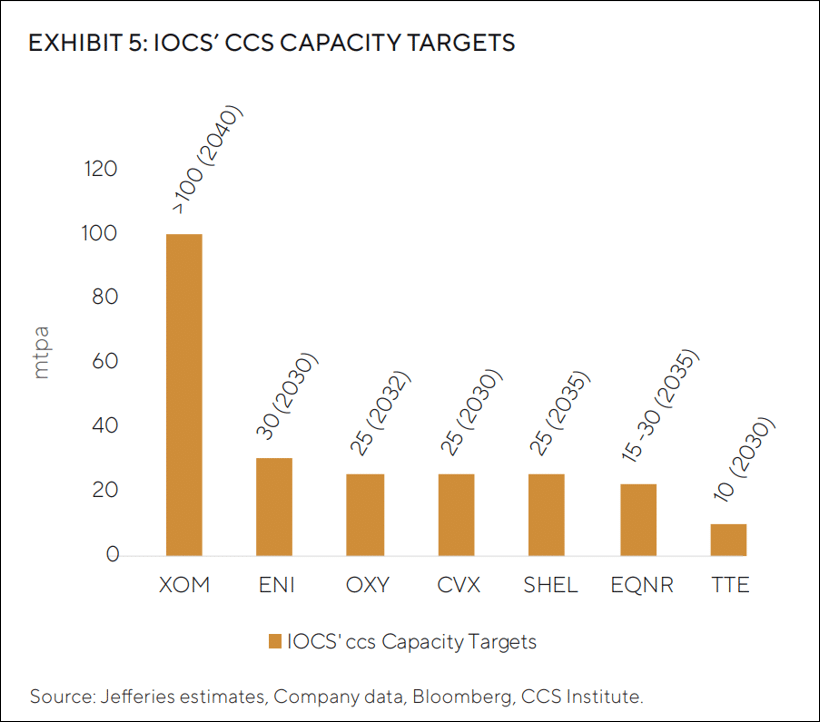

As illustrated in Exhibit 2, Occidental and ExxonMobil have the largest project portfolios due to legacy EOR applications in the Permian Basin. Exhibit 5 illustrates the capacity targets for leading IOCs, with ExxonMobil appearing the most ambitious. However, as Occidental currently captures ~20 mtpa, the company appears best positioned to achieve its capture targets. ExxonMobil’s capacity targets are based on projected DAC deployment and hub capacity, further detailed below, which are still under development. Despite the comparative advantage of US IOCs, peers across the pond are utilizing carbon capture technologies as well. BP and Shell lead the Europeans in current capture capacity, while TotalEnergies and ENI SpA have significant room for growth. In mid-2022, TotalEnergies signed its first commercial agreement to permanently store ~800,000 tons of CO2 per year beginning in 2025. This is just one of multiple advanced market commitments that are now being announced by industry groups and investors.

WHAT’S MOVING THE NEEDLE?

Policymakers have now come to the conclusion that incentivizing the storage of carbon is a key lever in driving global decarbonization. This presents further opportunities for legacy operators in the carbon capture space, as it extends the useful life of their assets and provides potentially higher revenue streams for existing storage infrastructure. In the US, government support has come from the 45Q tax credit — which provides $35 per ton for CO2 used in EOR and $50/t for permanent storage of CO2 up to 2026.7 The CCUS Tax Credit Amendments Act of 2021 proposed an increase in the value of the tax credit from $35/t to $75/t for EOR facilities and from $50/t to $120/t for facilities that sequester CO2. 8 Additionally, with the passage of the Infrastructure Investment and Jobs Act, Congress provided the Department of Energy with $3.5 billion for its Regional Direct Air Capture Hubs program. This is to be spent over the next five years across four DAC hub projects. Eligibility is tied to a project’s ability to capture 1 million tons annually upon completion, giving larger IOCs an upper hand due to the balance sheet needed to finance these developments.9

Following the passage of the Inflation Reduction Act (IRA), incentives for deploying carbon capture are now clear and the investment case is stronger than ever, in our opinion. The IRA increased 45Q tax credits to $85/MT for industrial carbon capture, utilization and storage (CCUS) and $180/MT for DAC (non-EOR). Most notably, 45Q tax credits generated in the first five years of operation will be paid upfront.10 Outside of the US, an agreement was reached at COP26 to develop a global carbon market with standardized rules between governments and corporations.11 This agreement formalized the creation of a centralized system open to the public and private sectors, and enhanced the stringency of rules governing the trade of credits between countries.12 It will have direct, immediate impacts to ongoing offset programs, such as CORSIA, which manages the global offsetting system for airlines. While the rules will be stricter, the agreement provides greater clarity to enable greater participation in the market.

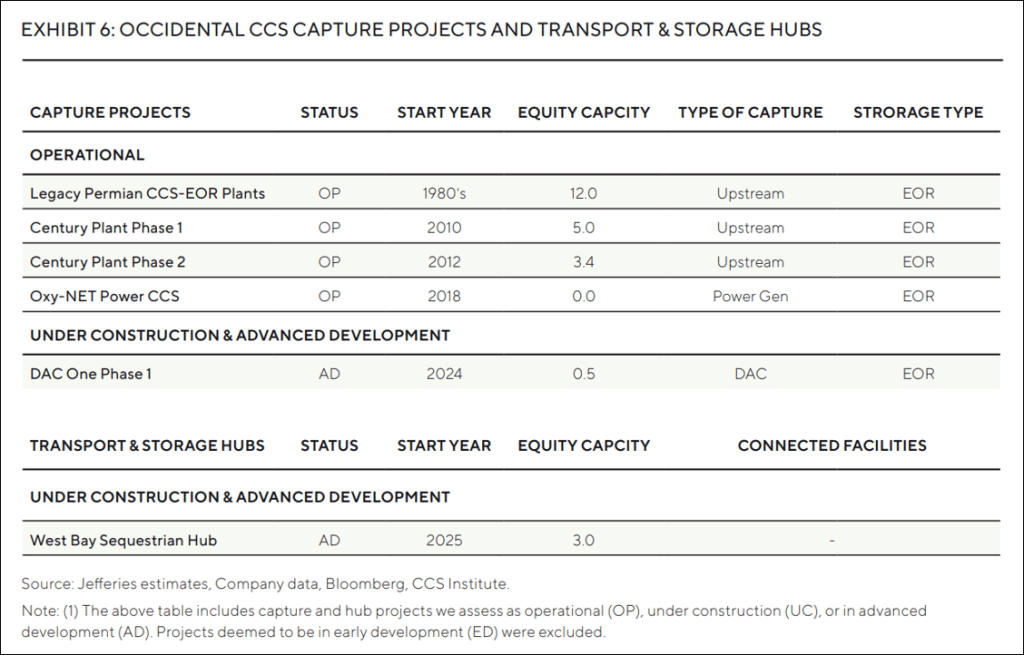

OCCIDENTAL PETROLEUM’S CCS PLANTS

We believe Occidental is well positioned to achieve their capture targets versus peers. Currently, Occidental has the greatest operational capacity for CCS projects through its legacy businesses in the Permian Basin. The company is also building experience through pilot projects with industry partners. Additionally, the company has an advanced development DAC project, aptly named DAC One. The project is expected to come online near the end of 2024 and should capture 0.5 mtpa, representing nearly $90 million of 45Q credit generation annually at $180/t. For any emissions that Occidental offtakes and stores, the point-source emitter will capture the $85/t credit and pay the company a portion for the transportation and sequestration services. As these credits are directly payable for the first five years, Occidental has the greatest near-term revenue opportunity from credit generation.

CONCLUSION

Carbon capture is, and will likely continue to be, an important solution as governments, investors, and other stakeholders look for leaders in climate change mitigation. The uses of CCS technology now extend beyond the oil and gas industry, with applications in steel, cement, and chemical production. This demonstrates the viability of and efficacy in CCS technology.

As the pipeline of CCS projects continues to grow, an important question to consider is whether we have the geological space to sequester the millions of tons of CO2. Fortunately, the answer to that question is yes. The IPCC estimates that technical geological storage capacity stands at nearly 1,000 Gigatons of CO2. To put it in perspective, this is more than the CO2 storage needed through 2100 to limit global warming to 1.5°C. However, in order to reach this goal by 2050, greater deployment of CCS technologies will be needed as well as supportive regulatory frameworks from government institutions.

Legacy oil and gas producers already have the patents and partnerships needed to deploy CCS, as well as healthy balance sheets to fund these projects. Perhaps most importantly, major IOCs need these developments to succeed in order to show how they are addressing the externalities associated with their operations. Companies such as ExxonMobil and Occidental have made clear their commitment to expanding the use of CCS technology, which represents not only a solution to lowering global emissions but also a valuable business opportunity.

END NOTES

1Psarras, P., et al. “Direct Air Capture: Assessing Impacts to Enable Responsible Scaling”. World Resources Institute. May 2022.

https://www.wri.org/research/direct-air-capture-impacts

2Lebling, Katie. “6 Things to Know About Direct Air Capture”. World Resources Institute. World Resources Institute. May 2, 2022.

https://www.wri.org/insights/direct-air-capture-resource-considerations-and-costs-carbon-removal

3Turan, G., et al. “Global Status of CCS 2021: CCS Accelerating Net Zero”. Global CCS Institute. November 2021.

https://www.globalccsinstitute.com/wp-content/uploads/2021/11/Global-Status-of-CCS-2021-Global-CCS-Institute-1121.pdf

4IEA. “Annual CO2 capture capacity vs. storage capacity, current and planned, 2020-2030”. Paris.

https://prod.iea.org/data-and-statistics/charts/annual-co2-capture-capacity-vs-storage-capacity-current-and-planned-2020-2030

5US EPA. Greenhouse Gas Equivalencies Calculator.

https://www.epa.gov/energy/greenhouse-gas-equivalencies-calculator

6Steyn, Matt, et al. “Global CCS Institute Status Report, Section 2: Ambition to Action,” Global CCS Institute. 2022.

https://status22.globalccsinstitute.com/2022-status-report/ambition-to-action/

7Jones, Angela C., Sherlock, Molly F. “The Tax Credit for Carbon Sequestration (Section 45Q).” Congressional Research Service. June 8, 2021.

https://crsreports.congress.gov/product/pdf/IF/IF11455

8Sentate Bill”S.986 – Carbon Capture, Utilization, and Storage Tax Credit Amendments Act of 2021”. United States 117th Congress. March 25, 2021.

https://www.congress.gov/bill/117th-congress/senate-bill/986

9Allen, Christopher, et. al. “Setting DAC on Track: Strategies for Hub Implementation”. Carbon180. April 2022.

https://static1.squarespace.com/static/5b9362d89d5abb8c51d474f8/t/6261d1890b76863f1047a2dd/1650577901659/Carbon180-SettingDAConTrack.pdf

10“Climate Tech VC. “IRA and the New Capital Cost of Climate #114”. Climate Tech VC. August 22, 2022.

https://www.ctvc.co/ira-and-the-new-capital-cost/

11”COP 26 Outcomes: Market Mechanisms and non-market approaches (Article 6)”. United Nations Framework Convention on Climate Change. 2022.

https://unfccc.int/process-and-meetings/the-paris-agreement/the-glasgow-climate-pact/cop26-outcomes-market-mechanisms-and-non-market-approaches-article-6#eq-6

12Krukowska, Ewa. “COP26 Finally Set Rules on Carbon Markets. What does It Mean?”. Bloomberg US Edition. November 13, 2021.

https://www.bloomberg.com/news/articles/2021-11-13/cop26-finally-set-rules-on-carbon-markets-what-does-it-mean

IMPORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

NOTICE TO AUSTRALIA & NEW ZEALAND INVESTORS

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may only be provided to retail and wholesale clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be dis-tributed or passed on, directly or indirectly, to any other class of persons in Australia and New Zealand, or to persons outside of Australia and New Zealand.

NOTICE TO CANADIAN INVESTORS

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation or investment advice. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients in certain Canadian jurisdictions who are eligible “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

NOTICE TO UNITED KINGDOM INVESTORS

GQG Partners is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

GQG Partners (UK) Ltd. is a company registered in England and Wales, registered number 1175684. GQG Partners (UK) Ltd. is an appointed representative of Sapia Partners LLP, which is a firm authorised and regulated by the Financial Conduct Authority (“FCA”) (550103).

© 2023 GQG Partners LLC. All rights reserved. This document reflects the views of GQG as of May 2023.

TLFLI CCS0523