Key Takeaways

Despite geopolitical tensions and economic challenges, Brazil’s economy has emerged as a surprisingly strong performer, attributed to underappreciated structural reforms implemented over the past decade

Brazil’s economic transformation involved periods of hyperinflation, a booming market under President Lula, a corruption scandal, and subsequently, a return to pragmatic economic policies with ambitious reforms implemented from 2016-2022

Despite the risks associated with emerging markets, the current economic climate in Brazil, marked by a decade of reforms, balanced economic policies, and attractive valuations, presents some of the most compelling investment opportunities

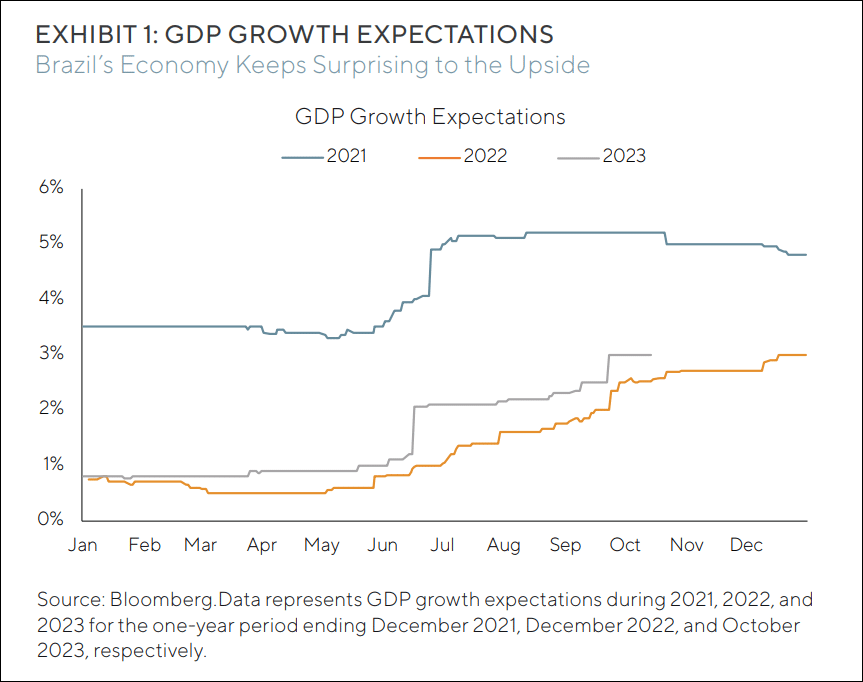

In a world full of geopolitical tensions, inflationary pressures, and collapsing banks, one major economy has been navigating the volatility remarkably well: Brazil. After recovering from its worst decade in more than a century, this approximately $2 trillion economy has quietly emerged as a surprise winner in the post-COVID world. Despite its central bank hiking interest rates from 2 per cent to almost 14 per cent, Brazil’s economy has beat market expectations for the third year in a row.1 We believe the country’s structural reforms over the past decade, which appear to be underappreciated by other investors, have positioned Brazil for continued outperformance.

A quick look at the country’s recent economic history can help us better understand the transformation Brazil has experienced over the years. For the sake of our analysis, we will break it down into three major periods.

PERIOD 1: 1990S HYPERINFLATION AND SUBSEQUENT REFORMS

Hyperinflation raged through Brazil’s economy in the early-1990s with four-digit annual inflation becoming a regular occurrence. In an effort to tame inflation at the start of the decade, President Fernando Collor de Mello implemented a radical plan that included freezing 80 per cent of all bank deposits.2 Collor had won the country’s first direct presidential elections after the country’s military dictatorship ended in 1985 but was soon impeached due to a corruption scandal in 1992.3

His vice president, Itamar Franco, took over and in our view, fortunately appointed Fernando Henrique Cardoso as the country’s finance minister. Cardoso spearheaded the now famous Plano Real, which was a series of measures designed to crush inflation – such as creating a new currency and tightening monetary policy.4 The program was, in our view, a great success with inflation collapsing from approximately 2,500 per cent in 1993 to 2 per cent in 1998 and then remaining below 10 per cent for most of the next three decades.

Cardoso served as Brazil’s president from 1994-2002 and accelerated the reforms. Inheriting a country that was exiting a turbulent period, Cardoso made significant long-lasting improvements, including the sale of several state-owned enterprises (SOEs) in a major privatization program.5 For example, he privatized Brazil’s state-owned mining firm, Companhia Vale do Rio Doce (now simply known as Vale, the largest iron ore miner in the world) in a landmark 1997 initial public offering.

Then came the 2002 presidential elections, where an elementary school dropout, steel worker, and union leader named Lula da Silva succeeded Cardoso to become Brazil’s next president.

PERIOD 2: 2000S BULL MARKET UNDER PRESIDENT LULA

Initially, markets panicked at the prospect of Brazil’s first working-class president; the Brazilian real collapsed nearly 40 per cent in the months leading up to his victory.6 After all, Latin America has a long history of failed socialist policies and Lula had all the hallmarks of a radical leftist, such as a close friendship with Cuba’s Fidel Castro and constant criticism of US economic policies.

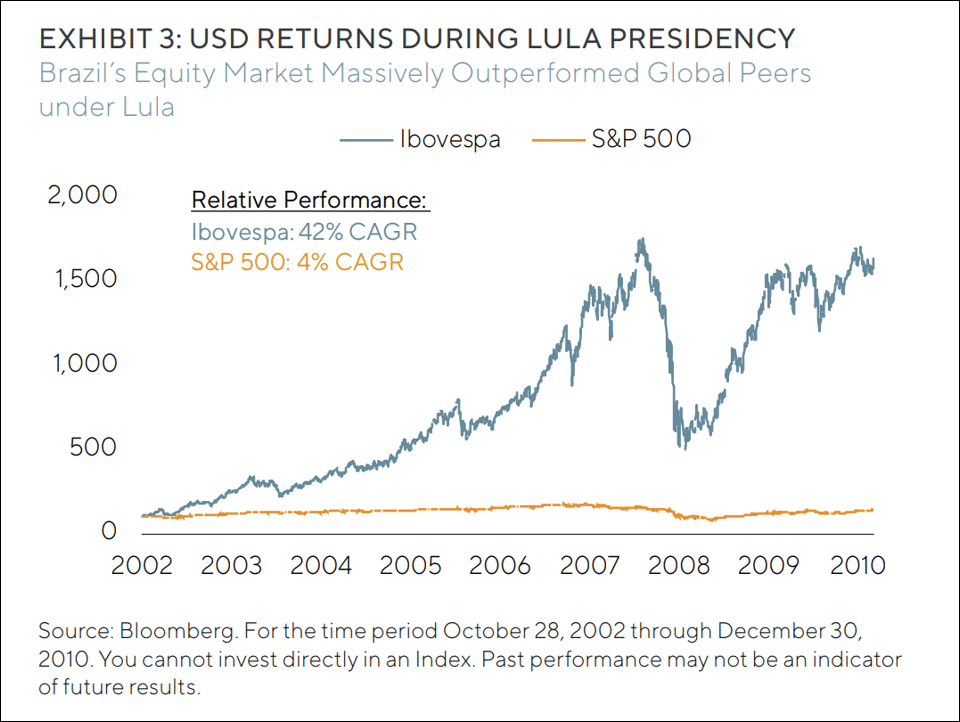

However, markets ended up miscalculating as Lula turned out to be a pragmatist. After winning the election, Lula continued Cardoso’s orthodox economic policies, surprising many with his market-friendly approach. As he once famously said, “I’m not ashamed to change my mind. I prefer to be a walking metamorphosis and change whenever the facts change.”7 Powered by a commodity bull market and a stable political environment, Brazil became one of the best performing stock markets in the world during his presidency.

President Lula’s pragmatic economic policies helped to grow Brazil’s foreign reserves nearly tenfold to $300 billion.10 The reserves helped Brazil navigate less robust economic environments and allowed for more degrees of freedom in its fiscal approach. Furthermore, his policies and social development programs helped lift over 20 million Brazilians out of poverty during his eight years in office.11

Unfortunately, the good times did not last forever as Lula’s handpicked successor, Dilma Rousseff, lacked his pragmatism.

PERIOD 3: 2010S CAR WASH SCANDAL AND SUBSEQUENT REFORMS

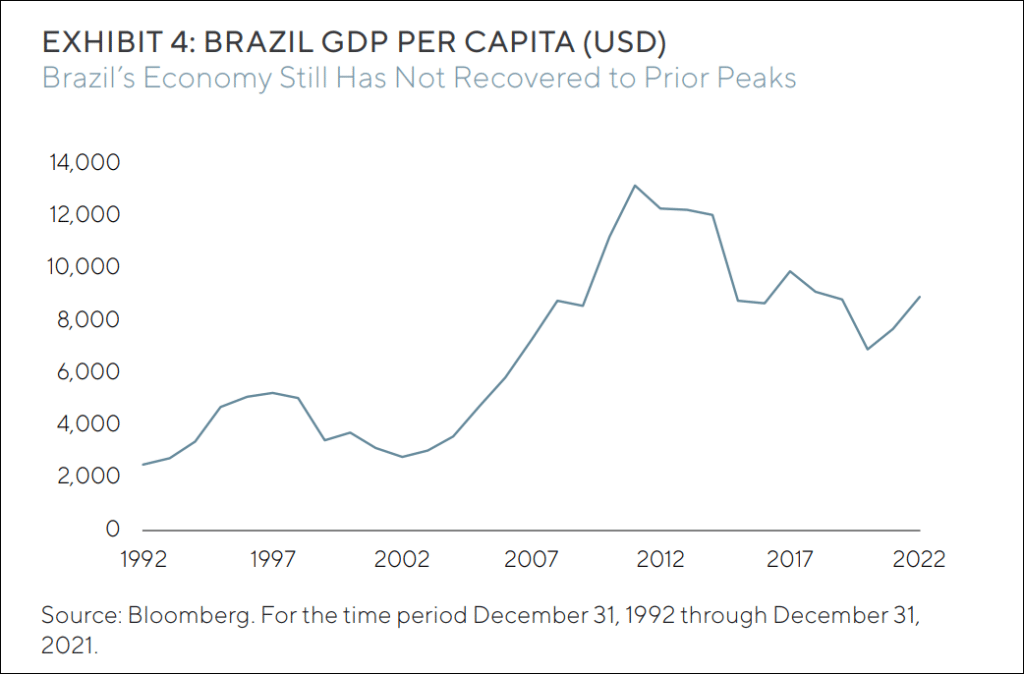

Lula stepped down at the height of his popularity in 2010 and helped Dilma Rousseff, a former Marxist guerilla, become Brazil’s next president. While she started off well, Dilma gradually abandoned orthodox economic policies, such as inflation targeting and balanced budgets.12 Instead, she used subsidized lending to promote growth, ignored pro-business reforms, froze prices, and constantly intervened in state-owned companies. At one point, Brazil’s development bank (BNDES) became bigger than even the World Bank.13 Then commodity prices collapsed in 2014, which destroyed any hope of an economic recovery and eventually caused Brazil’s sovereign debt to be downgraded to junk status.14 A decade later, Brazil’s GDP per capita is still approximately 30 per cent below 2011 levels.

The final nail in the coffin was the infamous Car Wash Scandal. An apparent routine investigation into money laundering ended up uncovering a massive corruption scandal involving state-owned oil producer Petrobras (the largest company in Brazil) and many prominent businessmen and politicians. The media labeled it the biggest corruption scandal in modern history.15 Dilma ended up being impeached by Congress in 2016 for breaking budget laws and her vice president Michel Temer took the country’s helm. Meanwhile, Lula was sent to prison in 2018 after being convicted on charges of money laundering and corruption. The Economist covers from 2009 and 2021 shown in Exhibit 5 highlight Brazil’s fall from grace over the past decade.

BAD TIMES LEAD TO BETTER POLICIES

In our view, there was an underappreciated silver lining to this lost decade of unorthodox policy and scandal. The result was a return to a more pragmatic approach, similar to the pivot witnessed in the 1990s to address hyperinflation. After Dilma’s impeachment in 2016, Brazil’s next two presidents – Michel Temer and Jair Bolsonaro – appointed technocrats to help turn around the economy. From 2016-2022, we believe Brazil implemented some of the most ambitious economic reforms within emerging markets.

SOE POLICY

Brazil has more state-owned companies than most major economies, which is problematic because SOEs are highly prone to political meddling, inefficient operations, and poor capital allocation decisions. They also crowd out private sector investments that tend to be more efficient.

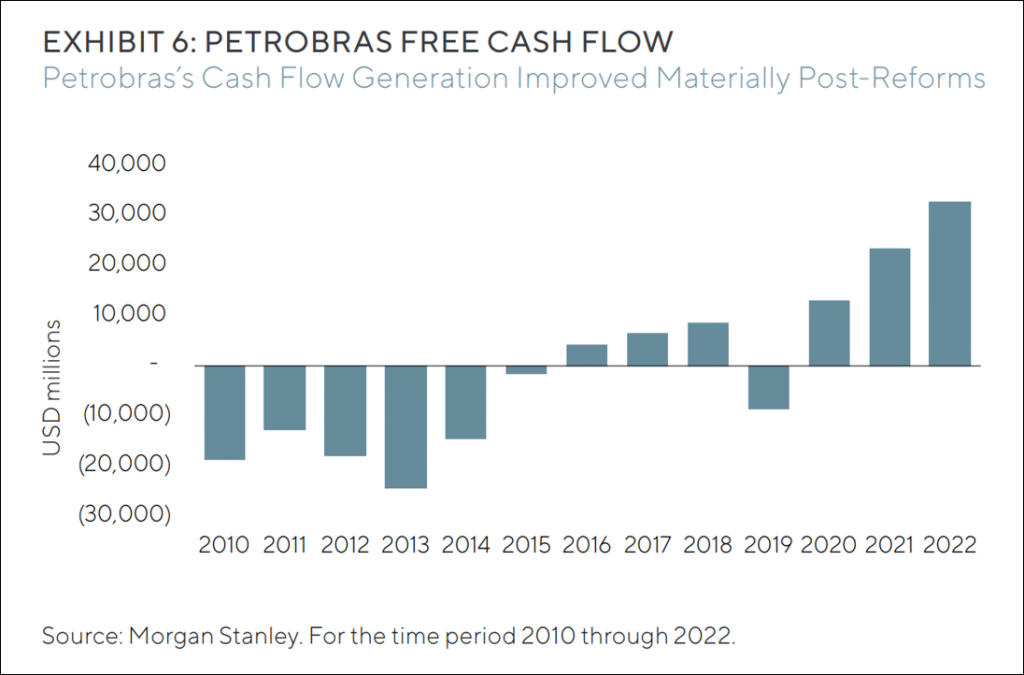

After the Car Wash Scandal, the government acted aggressively to manage its SOEs via legislation, reforms, and privatizations. In 2016, Brazil passed a law to protect SOEs and their minority shareholders from political interference.16 As the biggest SOE and the epicenter of the Car Wash Scandal, we believe Petrobras is a great case study of these reforms. After nearly going bankrupt during the Dilma administration, the company appears to have been completely turned around over the past few years. Petrobras hired experienced executives, cleaned up its balance sheet, improved corporate governance, and divested non-core assets. As a result, Petrobras made as much money as Chevron (a company with 3 times the market cap) last year and paid ~$60 billion in dividends since 2021 relative to its current $100 billion market cap.17 Regarding privatizations, Brazil sold off dozens of SOEs including Eletrobras, the largest power utility in Latin America.18

FISCAL POLICY

Brazil passed a series of much-needed reforms to tackle its mounting fiscal deficit. For example, after decades of attempts, the country finally passed a landmark pension reform bill in 2019. Brazil’s pension is one of the most bloated globally and previously accounted for approximately 45 per cent of the federal government’s budget.19 This bill alone is expected to save the government nearly $200 billion by creating a minimum retirement age, increasing worker pension contributions, and other important elements.

MONETARY POLICY

Brazil’s central bank officially gained autonomy from the executive branch in 2021. Previously, the central bank’s governor served at the president’s will and had no fixed terms, which allowed politicians to influence monetary policy.20 Full independence allowed Brazil’s central bank to react quickly and aggressively to the post-COVID spike in inflation by raising interest rates 1200 basis points within 18 months. As a result, Brazil’s inflation rapidly collapsed, allowing the central bank to start cutting rates well ahead of most developed markets.

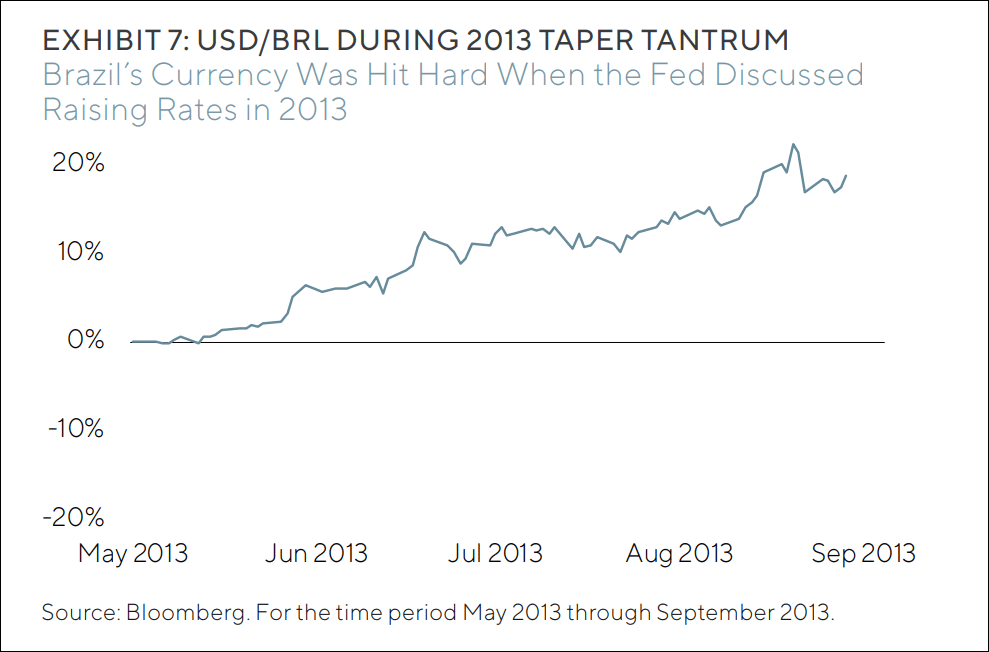

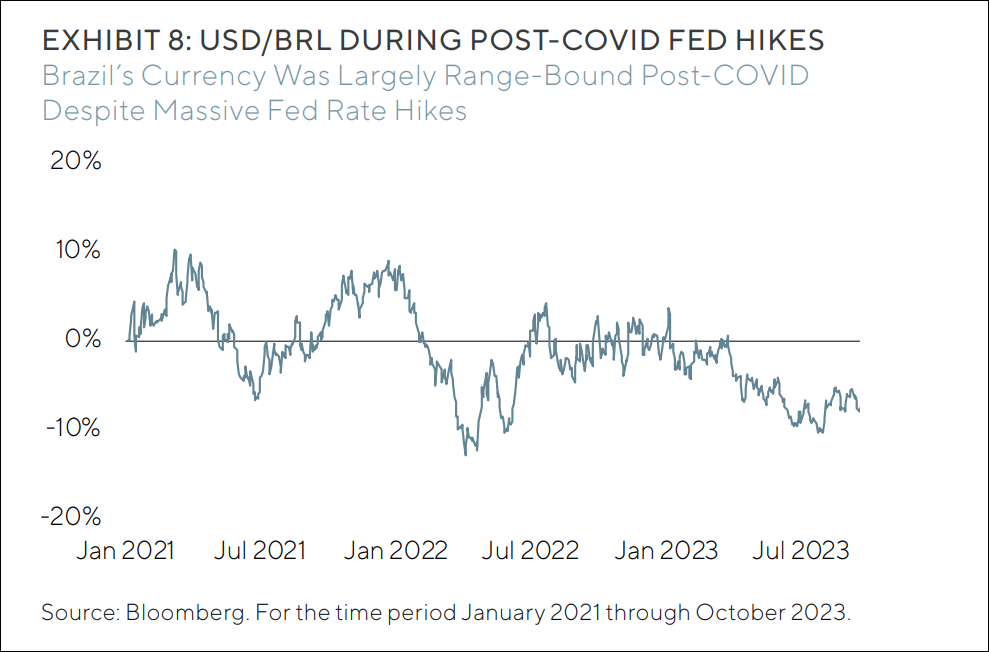

Furthermore, the Brazilian real performed well recently despite significant Federal Reserve rate hikes, recession fears, and political uncertainty. In contrast, the same currency imploded within weeks at the mere hint of rate hikes during the 2013 taper tantrum and was deemed one of Morgan Stanley’s Fragile Five currencies.21

BUSINESS POLICY

For business owners, Brazil has what we think is a well-deserved reputation for being a difficult country to operate in. While the government announced several major initiatives over the past few years to improve the ease of doing business, we believe there is still a lot more work to be done. However, in 2017, the country passed its first major labor reform bill in decades. The bill diluted collective bargaining, gave companies more control over workers’ hours, and reduced the scope for legal action in labor disputes.22

Similarly, in 2020, Brazil’s central bank launched an electronic payment scheme called PIX to reduce reliance on cash transactions.23 In under three years, 80 per cent of the adult population has used the system and payment volumes are approximately 5 times greater than those for debit and credit cards combined. In fact, Brazil had the fastest adoption rate for electronic payment systems globally. Not bad for an emerging market!

SO WHERE ARE WE TODAY?

History may not always repeat, but we think it often rhymes. We believe the Brazil of today shares many similarities with the Brazil of 20 years ago.

DECADE OF REFORMS

Like in the early 2000s, Brazil has just undergone a complete restructuring of its economy after a major blowup. People often forget that it takes time for reforms to translate into improved economic growth. For example, in a recent white paper, we discussed India’s economic reforms under the Modi administration. It took several years for the Indian economy to turn from a laggard into the powerhouse it is today. Similarly, we do not think it is a coincidence that the Brazilian economy keeps surprising to the upside despite materially higher rates.

LULA ELECTION FEARS

Similar to 2002, markets panicked at the prospect of a Lula presidency in 2022. However, like in his first two terms, Lula has largely maintained a balanced approach with his economic policies. For example, his administration is targeting a balanced budget next year – in contrast to most developed markets.22 Furthermore, a powerful, right-leaning Congress has promised to keep in place the reforms from the prior decade.25

COMMODITY TAILWINDS

As discussed in prior white papers, we believe commodity prices will remain higher for longer. While a sluggish Chinese economy will likely keep a ceiling on commodity prices, we believe a tight supply/demand environment will help commodity exporters like Brazil. Furthermore, Brazil has been at the forefront of the energy transition with hydropower supplying approximately 65 per cent of its electricity demand.26

ATTRACTIVE VALUATIONS WITH HIGH DIVIDEND YIELDS

Despite strong fundamentals, Brazilian equities still trade at highly depressed valuations.1 At the country level, the Ibovespa trades at 8 times earnings per share (EPS) versus 11 times over the past decade with a 7 per cent dividend yield. At the company level, Petrobras trades at 4 times EPS with some of the highest-quality oil assets in the world. As reference, CNOOC trades at a similar valuation despite being a sanctioned Chinese state-owned oil company. Similarly, BTG Pactual – one of the largest local banks – trades at 10 times EPS despite growing earnings at a nearly 30 per cent CAGR over the past 5 years and generating an approximately 20 per cent return on equity.

MONETARY STIMULUS

Brazil’s central bank, in our view, has been far ahead of the curve when dealing with inflation. It hiked interest rates well in advance of global peers and is now cutting interest rates. We expect lower interest rates to drive further economic growth and an increase in equity market valuations.

We believe these reforms are even more impressive when compared to the economic deterioration in the developed world. While Brazil is privatizing some of its utilities, Europe is nationalizing some of theirs. France’s government recently took over EDF, its biggest power utility. In addition, the UK was considering the nationalization of Thames Water, its largest water utility. We also note that European politicians have been slapping windfall taxes on certain banks and energy producers. Even in the US, certain financial institutions had difficulty navigating a rate hike of 500 basis points, which was far less onerous than the monetary tightening that we believe the Brazilian banks managed with relative ease.

THERE’S NO FREE LUNCH

Despite the promise, we believe it is always important to remember that Brazil is still an emerging market and unlikely to ever be a smooth ride. In our opinion, the biggest risk is a global economic slowdown, which would negatively impact demand for many of Brazil’s key commodity exports. The other risk is backtracking of reforms. Change tends to happen slowly in Brazil, so we will be monitoring any deterioration closely.

Overall, while the markets and media remain highly pessimistic on Brazil’s outlook, we believe the country offers some of the most attractive investment opportunities in the world.

DEFINITIONS

Earnings per share (EPS) is calculated as a company’s profit divided by the outstanding shares of its common stock. The resulting number serves as an indicator of a company’s profitability.

The compound annual growth rate (CAGR) is the rate of return (RoR) that would be required for an investment to grow from its beginning balance to its ending balance, assuming the profits were reinvested at the end of each period of the investment’s life span.

Return on equity (ROE) is a measure of financial performance calculated by dividing net income by shareholders’ equity.

END NOTES

1Bloomberg database on October 13, 2023.

2Silverstein, Ken. ”Brazil’s New Economic Plan Sends Wealthy on Run to Psychiatrists”, Los Angeles Times, May 20, 1990.

3Brooke, James. ”Brazil’s House Impeaches Collor; Suspended He Faces Senate Trial”, The New York Times, September 30, 1992.

4”The Real Plan. The ‘Plano Real’ stabilization program”

5Sao Paulo. “Let the Party Begin”, The Economist, April 24, 1997. www.economist.com/business/1997/04/24/let-the-party-begin

6Federico-O’Murchu, Sean. “Leftist heads for Brazilian victory”, NBC News. October 24, 2003. www.nbcnews.com/id/wbna3340827

7Traumann, Thomas. ”Lula Is Back. But Which Lula?”, Americas Quarterly. July 7, 2021. www.americasquarterly.org/article/lula-is-back-but-which-lula/

8Watson, Katy. “Brazil’s Lula: Saint or Sinner?”, BBC, September 12, 2018. http://www.bbc.com/news/world-latin-america-45168837

9Siddique, Haroon and agencies. “Fidel Castro holds ‘emotional’ meeting with Brazilian president”, The Guardian, February 25, 2010. http://www.theguardian.com/world/2010/feb/25/fidel-castro-cuba-lula-brazil

10FRED Economic Data. “Total Reserves excluding Gold for Brazil”, Economic Research, Observation: August 2023, Updated: September 25, 2023. https://fred.stlouisfed.org/series/TRESEGBRM052N

11The World Bank in Brazil: Overview”, The World Bank IBRD + IDA, Last Updated: October 9, 2023 https://www.worldbank.org/en/country/brazil/overview#:~:text=Poverty%20was%20cut%20in%20half,little%20progress%20in%20poverty%20reduction

12Books, Brad and Prada, Paulo. “Brazil’s Rousseff undone by hubris, economic missteps.”, Reuters, May 10, 2016. https://www.reuters.com/article/us-brazil-politics-rousseff-idUSKCN0Y12G6

13Andrade, Vinícius and Beck, Martha. ”Brazil Development Bank’s $29 Billion Divestment Push at Risk as Runoff Nears”. Bloomberg, October 21, 2022. www.bloomberglinea.com/english/brazil-development-banks-29-billion-divestment-push-at-risk-as-runoff-nears/

14”Brazil cut to ‘ junk’ credit rating by Standard & Poor’s”, BBC News, September 10, 2015. www.bbc.com/news/business-34205558

15Watts, Jonathan, “The Long Read. Operation Car Wash: Is this the biggest corruption scandal in history?”, The Guardian, June 1, 2017. www.theguardian.com/world/2017/jun/01/brazil-operation-car-wash-is-this-the-biggest-corruption-scandal-in-history

16Case Study 8: State Owned Enterprises. ” SOE Reforms in Brazil following “Lava Jato” “, The World Bank IBRD + IDA, September 2022. https://thedocs.worldbank.org/en/doc/802031611679806813-0090022021/original/SOEReformsinBrazilfollowingLavaJato.pdf

17Morgan Stanley database. Petrobras model date October 13, 2023.

18Andrade, Vinicius, Lucchesi, Cristiane and Gamarski, Rachel. ”Brazil’s Eletrobras Share Sale Raises $6.9 Billion in Latin America’s Biggest Equity Deal in 2022”, Bloomberg, June 9, 2022. www.bloomberg.com/news/articles/2022-06-09/brazil-eletrobras-stock-sale-said-to-raise-at-least-6-billion

19Schipani, Andres and Harris, Bryan. ”Can Brazil’s pension reform kick-start the economy?”, The Financial Times, October 22, 2019. www.ft.com/content/c32a93f2-f1d6-11e9-ad1e-4367d8281195

20Trevisani, Paulo. ”Political Crisis in Brazil May Revive Central-Bank Independence Debate”, Wall Street Journal, April 29, 2016. www.wsj.com/articles/political-crisis-in-brazil-may-revive-central-bank-independence-debate-1461971761

21Thomas Jr., Landon. ”‘Fragile Five’ Is the Latest Club of Emerging Nations in Turmoil”, The New York Times, January 29, 2014. www.nytimes.com/2014/01/29/business/international/fragile-five-is-the-latest-club-of-emerging-nations-in-turmoil.html

22Reuters Staff. “Brazil faces ‘extraordinary’ but crucial challenge on labor reform: government official”, Reuters, September 5, 2019. www.reuters.com/article/us-brazil-economy-reform/brazil-faces-extraordinary-but-crucial-challenge-on-labor-reform-government-official-idUSKCN1VQ259

23International Monetary Fund. Western Hemisphere Dept. ”Pix: Brazil’s Successful Instant Payment System”, IMF eLibrary, July 31, 2023. www.elibrary.imf.org/view/journals/002/2023/289/article-A004-en.xml

24Viotti Beck, Martha. ”Lula Seeks to Spend More, Close Budget Gap With Taxes”, Bloomberg, August 31, 2023. www.bloomberg. com/news/articles/2023-08-31/lula-seeks-to-spend-more-close-budget-gap-with-taxes-in-2024

25Pooler, Michael and Stott, Michael. “Brazil’s Speaker vows to stop Lula going ‘backward’ on reform”, Financial Times, May 16, 2023. www.ft.com/content/e546e85e-ec56-4f06-88de-6ab434be8da6

26Johnson, Slade, Manzagol, Nilay, and Antonio, Katherine. ”Hydropower made up 66% of Brazil’s electricity generation in 2020”, EIA, September 7, 2021. www.eia.gov/todayinenergy/detail.php?id=49436

IMPORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.

INFORMATION ABOUT BENCHMARKS

The S&P 500® Index is a widely used stock market index that can serve as barometer of US stock market performance, particularly with respect to larger capitalization stocks. It is a market-weighted index of stocks of 500 leading companies in leading industries and represents a significant portion of the market value of all stocks publicly traded in the United States.

The BOVESPA Index, commonly known as IBOVESPA, is the primary performance indicator of stocks traded on the Sao Paulo Stock, Mercantile & Futures Exchange.

It is not possible to invest directly in an index.

NOTICE TO AUSTRALIA & NEW ZEALAND INVESTORS

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may only be provided to retail and wholesale clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be dis-tributed or passed on, directly or indirectly, to any other class of persons in Australia and New Zealand, or to persons outside of Australia and New Zealand.

NOTICE TO CANADIAN INVESTORS

This document has been prepared solely for information purposes and is not an offering memorandum nor any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation or investment advice. This information is confidential and for the use of the intended recipients only. The distribution of this document in Canada is restricted to recipients in certain Canadian jurisdictions who are eligible “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations.

NOTICE TO SOUTH AFRICAN INVESTORS

Investors should take cognisance of the fact that there are risks involved in buying or selling any financial product. Past performance of a financial product is not necessarily indicative of future performance. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and market conditions. The investment value of a financial product is not guaranteed and any Illustrations, forecasts or hypothetical data are not guaranteed, these are provided for illustrative purposes only. This document does not constitute a solicitation, invitation or investment recommendation. Prior to selecting a financial product or fund it is recommended that South Africa based investors seek specialised financial, legal and tax advice. GQG PARTNERS LLC is a licensed financial services provider with the Financial Sector Conduct Authority (FSCA) of the Republic of South Africa, with FSP number 48881.

NOTICE TO UNITED KINGDOM INVESTORS

GQG Partners is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

GQG Partners (UK) Ltd. is a company registered in England and Wales, registered number 1175684. GQG Partners (UK) Ltd. is an appointed representative of Sapia Partners LLP, which is a firm authorised and regulated by the Financial Conduct Authority (“FCA”) (550103).

© 2023 GQG Partners LLC. All rights reserved. This document reflects the views of GQG as of October 2023. TLFLI BRZL1023