Key Takeaways

Successfully navigating market crises involves prioritizing risk management, focusing on absolute return in long-only equities, and avoiding common behavioral finance tendencies

During times of market stress, it’s important to understand that cheaper stocks don’t necessarily equate to safety, and large, stable companies with experienced management teams are often better investments

Active portfolio management, including upgrading the portfolio and eliminating risks when possible, is crucial in volatile market conditions to exploit price distortions and reduce exposure to high-risk sectors

For nearly 30 years, Rajiv Jain, Chairman and Chief Investment Officer of GQG Partners has been successfully navigating markets all around the world. In this report, Mr. Jain provides five guideposts that he utilizes for navigating risks and downturns in the global equity markets.

Forward

Over the last 30 years, I’ve found the key to managing through a market crisis begins with having the right client focus and philosophy. First and foremost, it is a privilege to be managing investment portfolios on behalf of our clients. Our clients depend on our firm to compound their capital in both good times and bad. We begin with an absolute return mindset in long-only equities. This straightforward investment philosophy provides a foundation on how we go about managing global equities over a full market cycle.

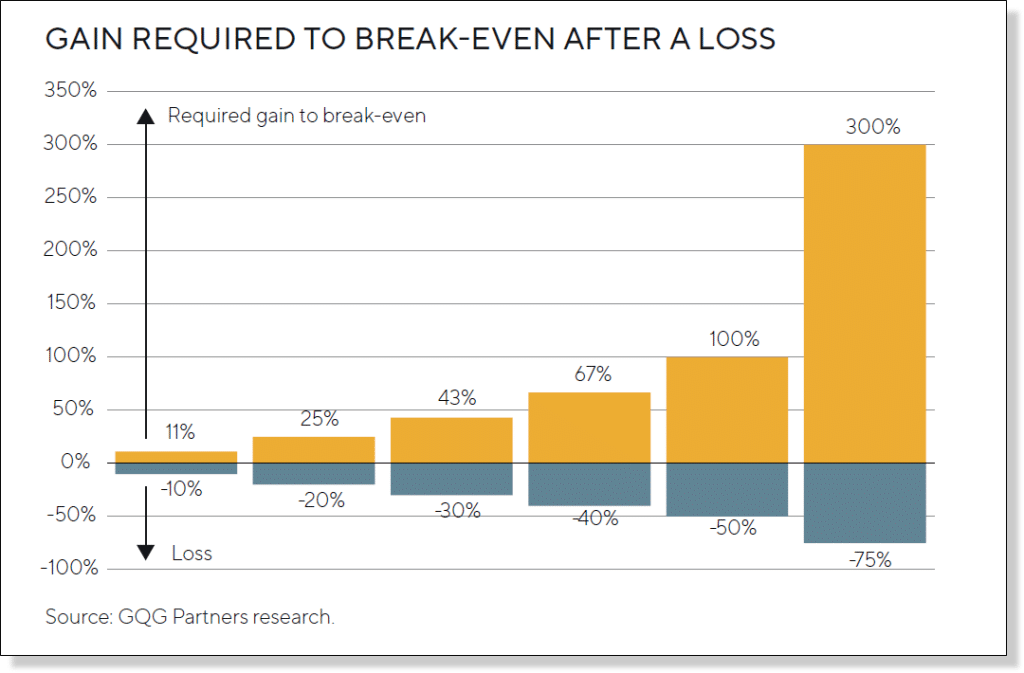

I believe as active, long-only investors, it is our responsibility and mission to limit the full impact of a market crisis. It is difficult to avoid all the losses of a market correction since stock prices typically move together based on correlations and market sentiment. Nonetheless, losing less means a higher starting point when the market eventually recovers.

We believe protecting against severe market corrections is critical to unleashing the power of compound growth when markets begin to recover. Often the impact of market losses is not truly appreciated since the markets tend to be more positively biased. However, I believe investors should focus on risk-adjusted investment returns since this is the best path forward to building long-term wealth and a secure retirement.

When markets get volatile, I refer to these five straightforward, intuitive guideposts. However, the most powerful aspect of managing through a financial crisis is to be fully aligned with our clients. We are committed to being invested alongside our clients. I hope you enjoy the lessons I learned over three decades of managing global equities. I continue to use them today in navigating these everchanging global equity markets.

— Rajiv Jain, Founder, Chairman & CIO of GQG Partners

Why It Is Important to Manage Downside Risk

Downturns occur regularly over market cycles. We believe being prepared for bear markets and market corrections can help you navigate the inevitable twists and turns without taking undue risks and suffering potential losses.

Taking on more risk may result in larger losses during a market downturn. As the loss increases, the gain required to get back to break-even is magnified and in some cases is unfathomable.

Why do serious long-term investors entrust their capital with GQG Partners during times of great uncertainty?

—Even before the bear market of 2022, the global equity markets have increasingly become more susceptible to event risk or shocks to asset prices across various asset classes. An example of this in action is the COVID-related correction that resulted in the worst quarter for the stock market in more than 100 years. Today, the market faces a volatile future with rising inflation, soaring debt levels, and further geopolitical instability.

—During these uncertain markets, we believe it is important to learn from an investor who — for almost 30 years — has successfully navigated multiple financial crisis events in both developed and emerging markets around the globe.

—Over his career, Rajiv Jain has built two successful global asset management firms. As founder and Chief Investment Officer of GQG Partners, Rajiv has grown the company to nearly $90 billion in AUM in less than six years. Prior to founding GQG Partners, Rajiv was CIO and Co-CEO of Vontobel Asset Management US, where he helped guide the firm from less than $500 million in 2006 to over $50 billion prior to his departure.

Five Lessons GQG Considers When Managing Investment Portfolios Through a Market Crisis

Lesson #1

Avoid classic behavioral finance tendencies in a crisis like loss aversion, anchoring, and herd mentality – these will only further compound losses

HOW DO YOU AVOID TYPICAL BEHAVIORAL FINANCE AND INVESTOR PSYCHOLOGY ISSUES?

I find during times of extreme market stress, it is very easy to fall victim to behavioral finance tendencies, which are highly detrimental to achieving superior risk-adjusted returns. The ability to take advantage of opportunities resulting from severe sell-offs requires the avoidance of some of the more typical behavioral finance issues like loss aversion, anchoring, and herd mentality.

Over the years, I developed our devil’s advocacy research approach and the use of non-traditional analysts. Our process is specifically structured to stress test an investment opportunity from multiple points of view. We deploy more research resources to build greater conviction. In a financial crisis, looking both ways crossing a one-way street has saved us and our clients from getting run over by the market. The hardest part of investing is at the extremes because this is where luck or group think tends to be most prevalent. Fortunately, the many years of investing in the most challenging markets has taught me the value in managing risks first and returns second. Following the herd is often the first sign something may be wrong with valuations and investors’ perception of risk. After managing through 14 bear markets around the globe, skeptism becomes an asset in avoiding too much risk.

In a financial crisis, looking both ways crossing a one-way street has saved us and our clients from getting run over by the market.”

– Rajiv Jain

Lesson #2

Be sensitive to changes in the data and react even faster in a crisis – being dogmatic is the fastest way to negative performance results

WHAT HAS BEEN THE KEY ASPECT OF YOUR ABILITY TO MANAGE DOWNSIDE RISK?

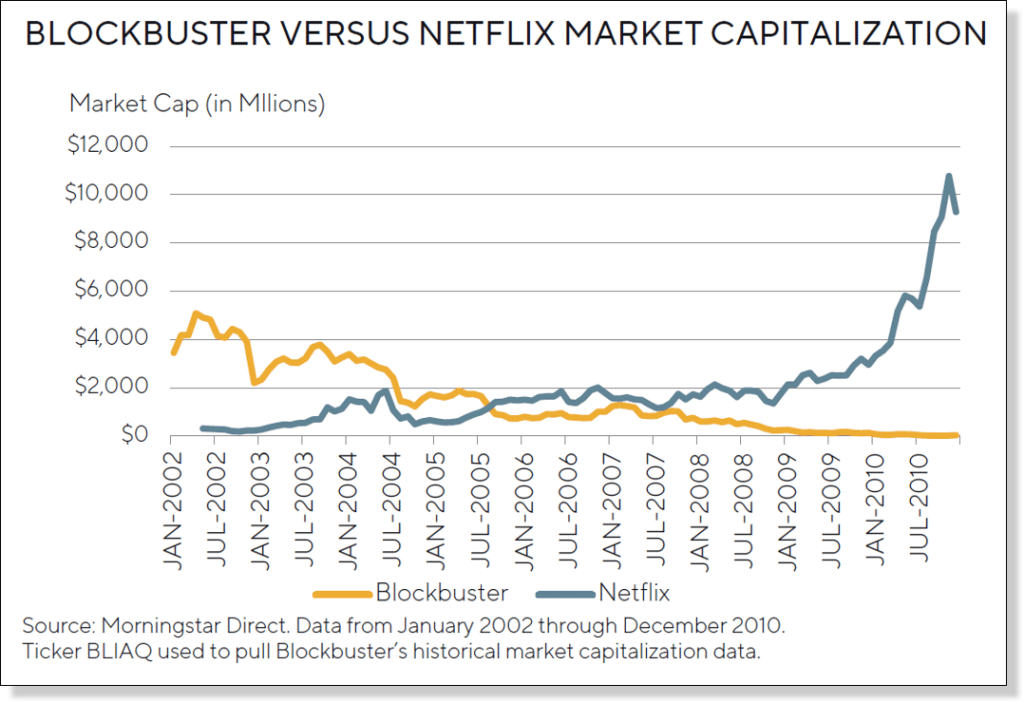

It is my belief there is a thin line between being disciplined and dogmatic, and I know a lot of former portfolio managers who were dogmatic. It is critical to understand the data points, which may often be conflicting during the most severe part of a market correction. For an active manager, this is our most valuable period for adding value for our clients. Staying objective, but reactive is critical. The Blockbuster versus Netflix saga is a great example of business adaptability. For years, Blockbuster dominated the video rental space, but failed to recognize and adapt to changing trends in technology and customer needs. When the price of a company is going against your thesis, then you need to look harder, but sometimes react even quicker. This is where experience counts. Since every bear market starts at the end of a bull market, understanding the similarities and differences from market tops and the start of market bottoms is often very subtle. Earnings and prices are not immune from gravity.

Nothing is permanent in investing, our job as portfolio managers is to react to change… a passive index cannot react.”

– Rajiv Jain

Lesson #3

Valuations matter but cheap does not mean safe in a crisis – many business models become vulnerable and wide business moats can become very shallow

YOU ARE NOT A VALUE MANAGER, BUT YOU HAVE PERFORMED BETTER THAN MOST IN A VOLATILE MARKET. HOW DO VALUATIONS SHAPE YOUR VIEW OF INVESTING?

I wrote a report titled “(Still) Waiting for Mean Reversion”, and highlighted some of the issues that plagued value investing. As a quality investor, I can appreciate the fundamental argument of not overpaying for future earnings streams. In a financial crisis, historically the lines between growth, value, and other factors begin to converge and blur at the same time. What was once growth is now value, and what was once cheap might be heading to bankruptcy. High dividend stocks might have to cut or suspend dividends or a downgrade in credit worthiness may impair borrowing facilities. Cheap does not necessarily mean a good value. Cheap could be a proverbial ‘train stop’ on a one-way trip to bankruptcy, government intervention, or dilution. In a crisis, an expensive stock might be the better investment opportunity; focus on certainty of earnings, strong, free cash flow, and durable balance sheets. Go beyond the traditional definitions as it pertains to style and look at the sustainability of a business if the economic environment changes. A traditional business or economic “MOAT” may no longer provide an adequate margin of safety.

Growth of capital is not a style, and it never goes out of favor.”

– Rajiv Jain

Lesson #4

Invest in stable, large cap companies managed by experienced management teams in a crisis – they know how to survive and prosper when the markets recover after the initial downturn

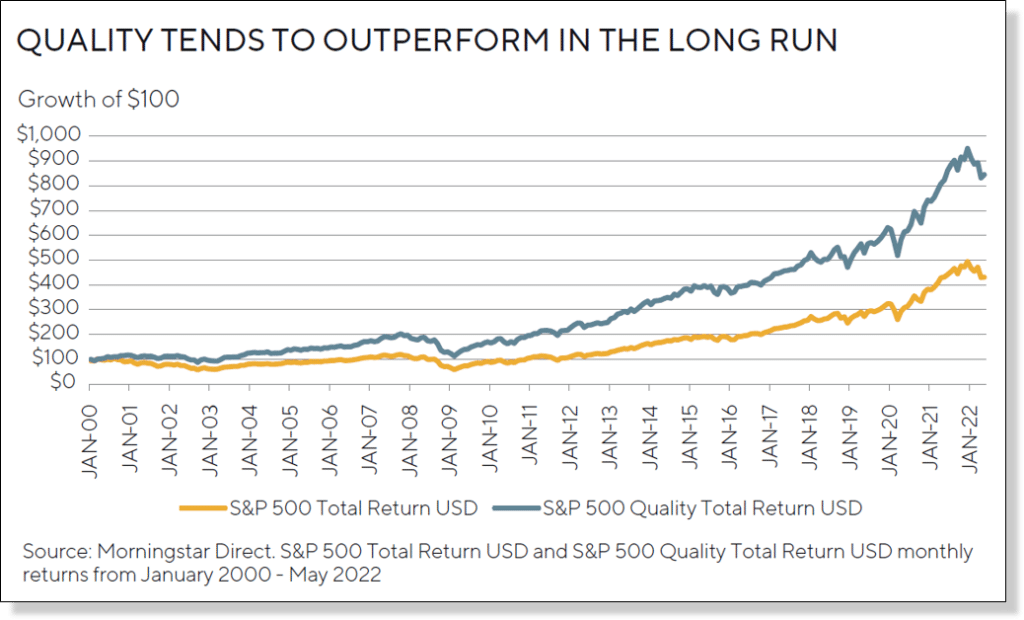

HOW HAS YOUR FORWARD-LOOKING QUALITY INVESTMENT APPROACH AIDED IN DELIVERING SUPERIOR RISK-ADJUSTED RETURNS FOR INVESTORS?

I learned very early in my investing career that in an economic downturn, companies with no or little debt, solid management, and reliable earnings tend to survive and prosper once the economic environment changes. Although this seems like common sense and much has been written on companies with strong economic moats, I am still amazed how many investors would rather overpay for unrealistic growth forecasts. Once again, this is where experience can help in understanding the business cycle in relationship to the economic cycle. In our approach, which I call Forward-Looking Quality, we seek to focus on ‘what could go wrong’ with our investment thesis. It is my experience that Group Think is the enemy of delivering superior investment returns. In a market crisis, large is safer than small, and quality companies with superior financial characteristics have certain inherent advantages in diversifying risks and exploiting opportunities, which result from an economic crisis. Deep value can always get cheaper and high growth can always get riskier.

If it keeps me awake at night, I sell it – or I sell down to my sleeping level.”

– Rajiv Jain

Lesson #5

Be active, upgrade the portfolio, and eliminate risks when possible

HISTORICALLY, GQG HAS DELIVERED SUPERIOR RISK-ADJUSTED RETURNS FOR INVESTORS. HOW IS THIS POSSIBLE WHEN MARKETS ARE PANIC SELLING?

During times of extreme volatility like we are experiencing now, we believe adaptability is critical in active management. The price of a company can become detached from the intrinsic value of a company. In our opinion, the efficient market thesis tends to break down in a severe correction since the rate of new information cannot be accurately reflected in the price of a company. The growth in passive investing may further increase price distortions in a crisis. The dislocation in price and valuation can provide active managers the ability to objectively isolate emotions from facts. Turnover during a crisis can lower current and future volatility by reducing exposures to certain sectors of the market experiencing extreme tail risk events like bank stocks in the Global Financial Crisis or technology stocks in the 2000 Tech Bubble. This allows an active portfolio manager to upgrade the portfolio across various factors like quality and volatility. An index or passive strategy like an ETF must continue to hold the company regardless of the risk of bankruptcy or further price declines.

I don’t have to fish in every pond. Only in the ones which have fish. If you don’t own it, you can’t lose money unlike the index that can’t sell it.”

– Rajiv Jain

Closing Insights

There are no short cuts or substitutes for experience and hard work in navigating a market crisis. The market only rewards luck for a finite period. The conventional wisdom of the day quickly becomes your nemesis. As active portfolio managers, our job is to compound capital consistently over the long-term. Serious investors seek superior risk-adjusted returns and typically avoid chasing the latest hot dot.

The triggers to a severe market correction are never perfectly alike. The 2000 crisis was a technology bubble; the 2008 crisis was a real estate bubble; the recent 2020 crisis a global pandemic and now the inflation fueled correction of 2022.

From my perspective, today’s challenges feel like a combination of the past 10 corrections over the past 40 years. Often the crisis is made much worse by valuation extremes coupled with some type of behavioral or structural excess such as extreme leverage in the financial system or loose regulatory controls. Unfortunately, the market keeps delivering a new crisis and a new lesson. Our job is to anticipate periods of uncertainty and adapt to changing data points.

I have managed through many global corrections across markets around the world, and I believe this experience has provided me with a general understanding on how to navigate through periods of tremendous uncertainty.

— Rajiv Jain, Founder, Chairman & CIO of GQG Partners

IMPORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange.