Key Takeaways

The risk of substantial capital gains distributions, referred to as a Capital Gains Tax-Alanche, is high in 2022 due to a series of events such as a market correction and the significant growth in the market share of ETFs

While ETFs have certain advantages in minimizing the impact of capital gains distributions, investing in mutual funds can offer tax benefits such as sheltering future gains with loss carry forwards

A variety of factors, including negative net cash flow, a loss greater than 15%, and trailing the appropriate index for the past 1-3 years, can indicate a fund’s risk of increasing redemptions and potentially higher realized capital gains distributions

Part One

Warning – 2022 Capital Gains Tax-Alanche Risk: EXTREME…Are you prepared?

GQG Partners Practice Management Insights — Preparing for Capital Gains Distributions

GQG Partners does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. It is advisable to consult tax, legal, and accounting advisors before engaging in any transaction. Please refer to the Risks and Important Information at the end of this document.

BACKGROUND

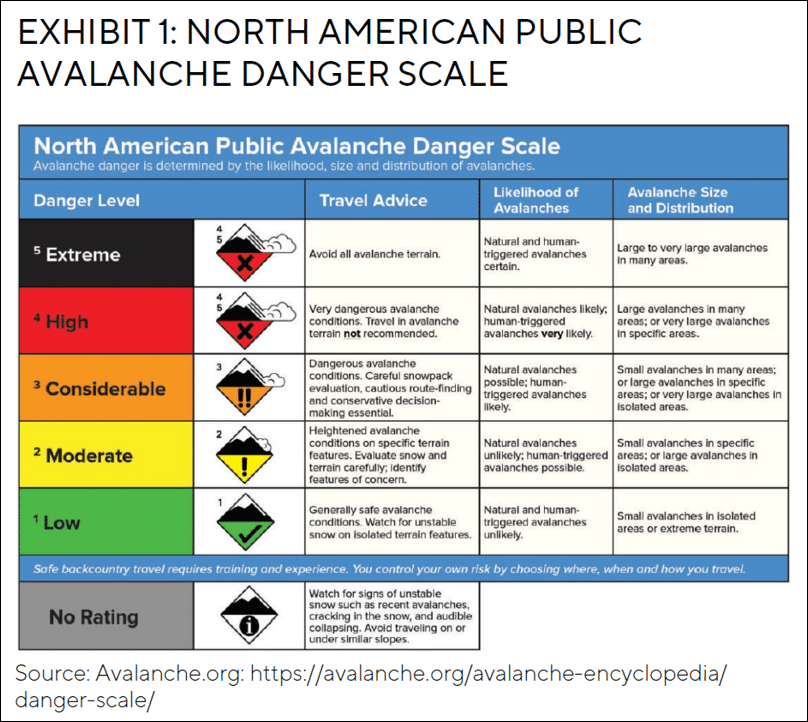

Every experienced skier knows an avalanche is something that needs to be carefully avoided. Often the Ski Patrol will follow a series of procedures to identify and mitigate this risk for the recreational skiers on the slopes. So, like avalanche season in the snow-covered mountains during winter, financial professionals need to be equally careful to avoid the risks of capital gains season for mutual funds. Like the Ski Patrol must understand the potential danger level for avalanches, financial professionals need to also identify and avoid or minimize the risks of large or unintended capital gains distributions.

WHAT IS A TAX-ALANCHE?

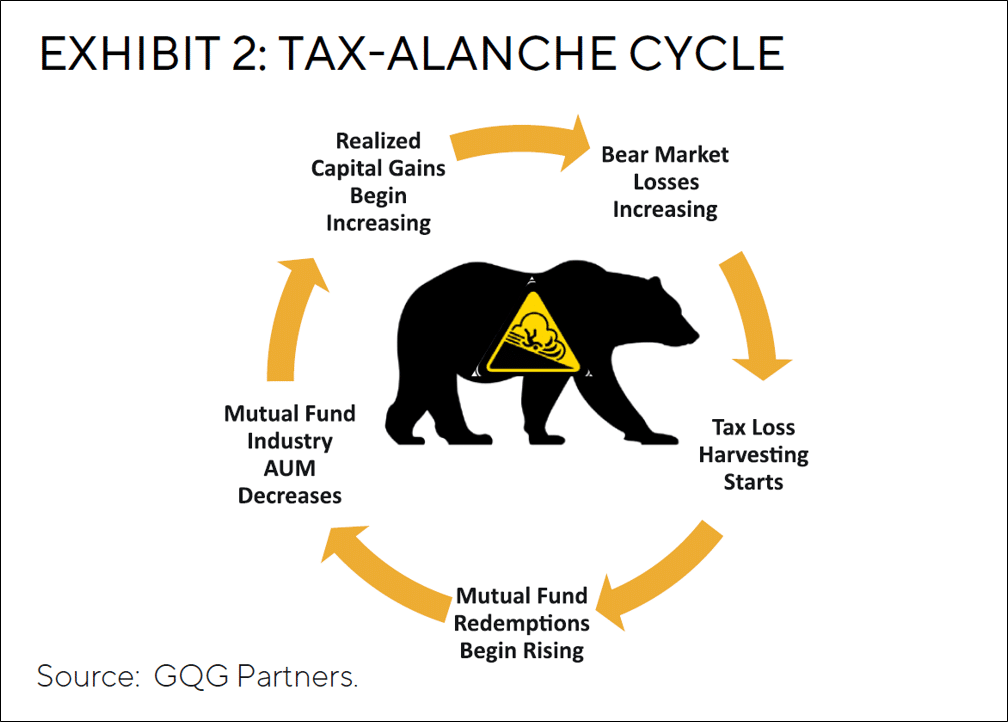

An avalanche in nature follows a predictable series of events that increases the risks of an avalanche occurring. Similarly, a Capital Gains Tax-Alanche is a term we use to describe a series of events that dramatically increases the risk of investors experiencing a large capital gains distribution.

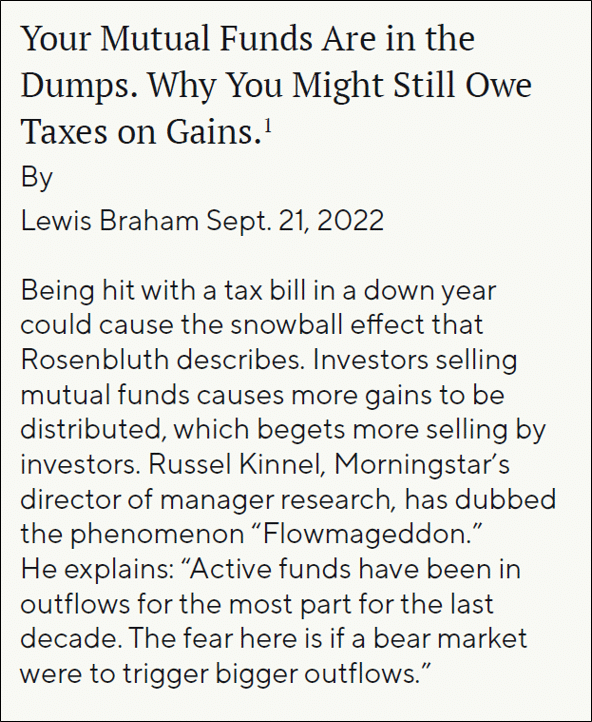

In a recent article in Barron’s, Russell Kinnel from Morningstar describes this series of events as “Flowmaggedon”.1 Regardless of your euphemism, we believe the end result is the same, an awkward discussion with your client about how they received a large capital gains distribution in their mutual fund after experiencing negative returns after only owning the fund for 13 months. Your client has just experienced a Tax-Alanche.

Sometimes the risk of a Tax-Alanche is LOW. Unfortunately, there is no uniform measure of Tax-Alanche risk like the chart in Exhibit 1 provided by Avalanche.org. However, in certain years, a series of events begins to build up until the risk of substantial capital gains distributions is extremely HIGH or even EXTREME. In 2022, the risk for many funds may be high and some of these funds were highlighted in the Barron’s article by Lewis Braham.1 There are a number of dynamic variables that change the size of a capital gains distribution before the date of record.

It is important to highlight that investors in a tax deferred vehicle like an IRA or Qualified Retirement Plan are not impacted by capital gains. Unfortunately, it is still important to identify mutual funds that may be distributing a large capital gain since it may also impact the costs and performance of the fund. In general, there are not a lot of positives from a mutual fund distributing a large capital gain to shareholders.

THE CAUSES OF A CAPITAL GAINS TAX-ALANCHE

The end of a bull market is often the beginning of a bear market. Often, a bear market may be the triggering event for a Tax-Alanche. However, the difference with this 2022 bear market is the significant growth in the market share of ETFs. These financial instruments have a number of distinct advantages in terms of minimizing the impact of capital gains distributions. They do not fully eliminate the impact, but the creation and redemption basket mechanism may eliminate the issues impacting mutual funds. Additionally, most ETFs are passive or follow a rules-based strategy with limited turnover. However, it is the elimination of commissions or transaction costs that was the tipping point in ETFs gaining significant market share. The growth of ETFs is potentially increasing the size of capital gains distributions in 2022.

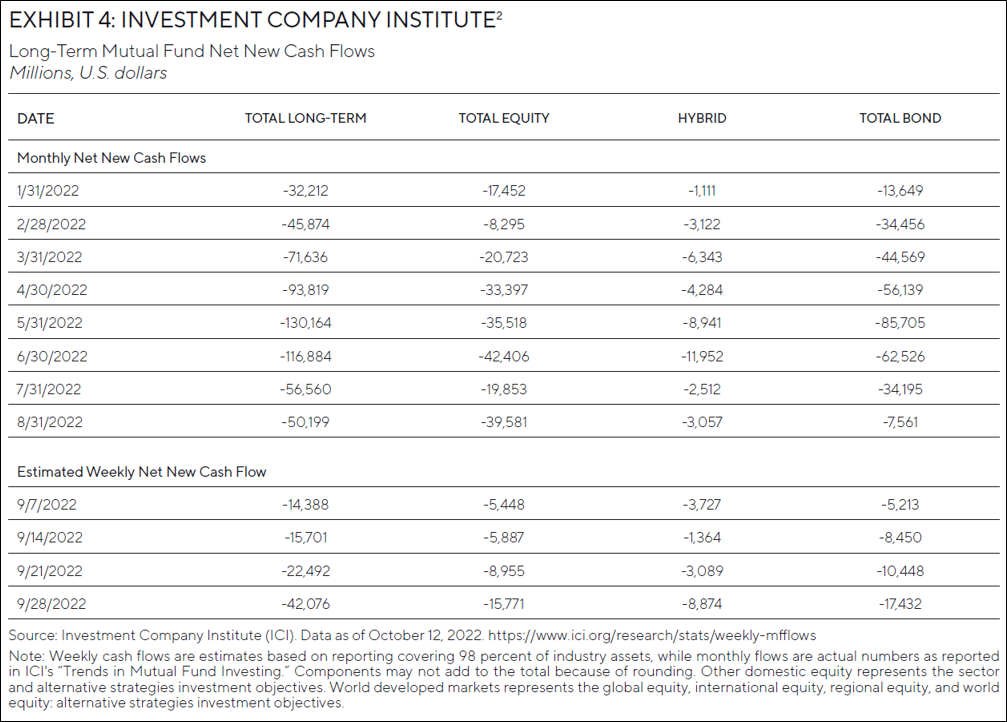

Historically, and recent market events would indicate, a Tax-Alanche begins with a market correction or a bear market. As the year progresses and the reality of the bear market sets in, investors begin to harvest losses. In the case of mutual funds, investors may now look to use ETFs as a lower cost wash-sale vehicle. This is only further fueling the popularity of ETFs and the risks of a Tax-Alanche. In past bear markets, investors often selected mutual funds within the same fund family. However, the growth of mutual fund supermarkets like the Schwab OneSource program has changed this process. When mutual fund redemptions rise, the net number of shareholders decrease for a specific fund. This will often result in realized capital gains increasing (see Exhibit 4: ICI mutual fund YTD cash flow chart).

There are a number of other factors that begin to impact this vicious Tax-Alanche cycle. For example, certain funds are hit with increasing redemption requests and this can outstrip a portfolio manager’s ability to manage the size of the realized capital gains distribution for the fund. At some point, the fund develops HIGH or EXTREME Capital Gains Tax-Alanche risk.

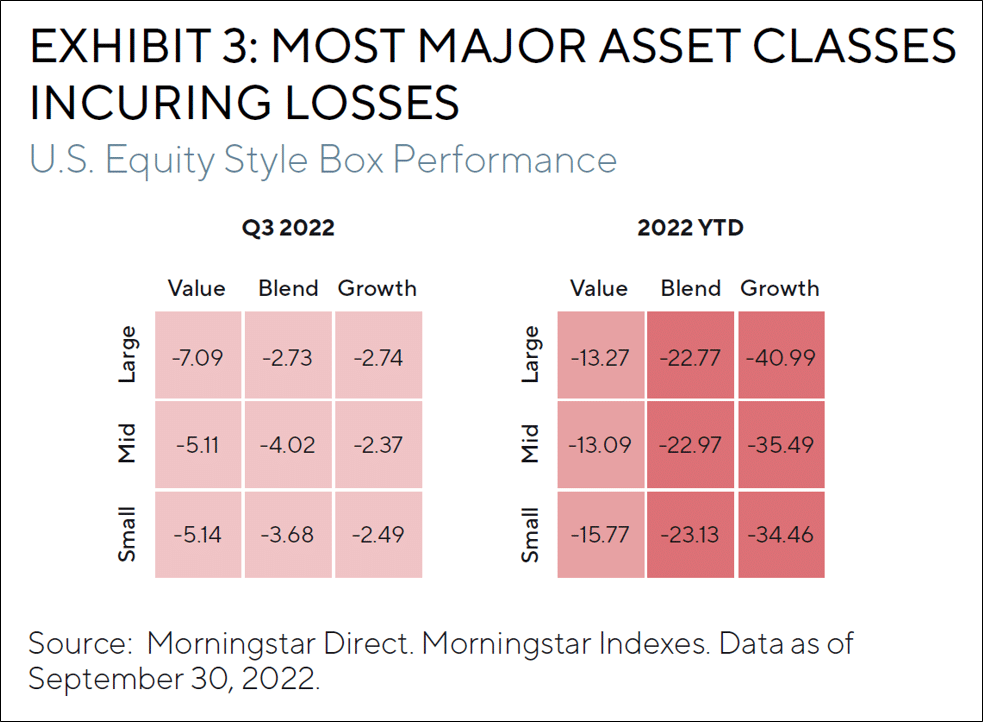

The worse the performance of the fund or asset class, the bigger the risks are since those funds provide the biggest opportunity for tax loss harvesting benefits. Exhibit 3 highlights the performance of various equity asset classes in the third quarter and year to date in 2022. As shown in this chart, most major asset classes have incurred losses. In past bear markets, fixed income was often the refuge for investors. In 2022, investors will likely be harvesting losses across their entire portfolio.

WHAT CAN FINANCIAL PROFESSIONALS DO TO IDENTIFY POTENTIAL FUNDS WITH THE HIGHEST OR MOST EXTREME TAX-ALANCHE RISKS?

Most financial professionals have moved to ETFs and SMAs as investment solutions to help avoid the future risks of large capital gains distributions. However, this may be short-sighted since investing in mutual funds may provide a number of advantages for savvy investors. For example, mutual funds can shelter future gains with loss carry forwards. Identifying mutual funds post a bear market during an EXTREME Tax-Alanche season can sometimes result in a fund with a loss carry forward. This tax treatment can shelter future capital gains for shareholders.

Another example of these tax benefits can be captured in a new or growing fund. A fund experiencing strong net inflows may potentially dilute realized capital gain exposures in the future, thus spreading the capital gains tax obligation per share to future shareholders in the fund. Additionally, the make-up of underlying shareholders in a fund can be critical information. In the case of retirement plan investors like a 401K plan, capital gains distributions have zero impact and flows from retirement plan investors may dilute future capital gains distributions for taxable investors.

The mutual fund industry is suffering one of the worst years on record for net cash flow with every month experiencing negative outflows across the major asset categories. Often net negative cash flows out of mutual funds can be a contributing factor in higher capital gains distributions.

It is imperative that financial professionals fully understand the entire operational and performance profile of a mutual fund in order to understand the tax profile of a fund. It is critical to look beyond just performance to understand the potential for future capital gains distributions. A fund with a large pre-distribution estimate of future capital gains may further be impacted by increasing redemptions. This can force a portfolio manager to sell the most liquid securities which results in the fund becoming more illiquid and incurring greater volatility. Some securities may be forced to be sold at much lower prices. This is a bigger risk in certain asset classes where capacity is constrained.

In our opinion, the caution signs provided below are a starting point to identifying a mutual fund that may have a future capital gains distribution issue. Once again, tax deferred clients are not directly impacted, but a fund incurring high redemptions may have other issues in executing the daily portfolio management activities.

IS YOUR FUND AT RISK OF RISING REDEMPTIONS AND POTENTIALLY HIGHER REALIZED CAPITAL GAINS DISTRIBUTIONS?

CAUTION SIGNS

Does your fund have a loss greater than 15 per cent?

✓ Tax loss harvesting risk often increases above losses of greater than 15 per cent.

Does your fund have negative net cash flow this year?

✓ A shrinking shareholder base increases the distributions per share.

Is your fund trailing the appropriate index for the past 1- and 3-years?

✓ Active mutual funds are losing market share to passive solutions like ETFs and index funds.

Does your fund have less than a 4-star rating by Morningstar?

✓ Mutual funds with less than 4 stars often have lower or negative net flows as a group.

Is your fund part of a proprietary target date or risk series of funds?

✓ Target Date funds are structured as a fund of funds and may often make re-allocations with little regard to the underlying shareholders which could trigger redemptions.

Has the fund paid capital gains in the past three years?

✓ Some portfolio managers may be more tax aware and will try to minimize net capital gains distributions.

Is the portfolio manager not co-invested in the mutual fund?

✓ Morningstar provides analytics to highlight the level of co-investment.

Has the fund had a net share decrease over the past twelve months?

✓ A decreasing shareholder base will increase the capital gains distributions per share.

Is the fund in a capacity constrained asset class?

✓ Capacity constrained asset classes may be at greater risk.

Has the fund had a portfolio manager change in the past twelve months?

✓ Funds are often placed on a watch list when there is a portfolio manager change and inflows may be impacted.

Has the fund lost more than 20 per cent of its AUM since January 1, 2022?

✓ Another method in determining the erosion of the shareholder base or the impact of negative performance.

If your fund is exposed to any of the aforementioned caution signs, then you may want to investigate the capital gains estimates provided by your fund company. Many fund companies work diligently to minimize the impact of realized capital gains distributions which can be both short- and long-term. Mutual fund companies will often provide estimates of capital gains distributions prior to the final distribution per share figures. There are a number of factors that may result in estimates changing prior to the record date of the fund. As always when dealing with tax-related analysis, it is important to discuss each specific client situation with the appropriate tax professional.

CONCLUSION

2022 could be shaping up to be an EXTREME Tax-Alanche season. It is important to work with the various mutual fund companies to fully understand the current capital gains distributions across the funds impacting your clients. The magnitude of this bear market and the impact of ETFs on mutual fund flows may further increase the Tax-Alanche risks for mutual funds.

GQG Partners does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. It is advisable to consult tax, legal, and accounting advisors before engaging in any transaction. Please refer to the Risks and Important Information at the end of this document.

FOOTNOTES

1Lewis Braham, “Your Mutual Funds Are in the Dumps. Why You Might Still Owe Taxes on Gains.”, Barrons, September 21, 2022, https://www.barrons.com/articles/capital-gains-taxes-mutual-funds-down-51663709001?mod=past_editions

2Investment Company Institute (ICI). Data as of October 12, 2022. https://www.ici.org/research/stats/weekly-mfflows

Note: Weekly cash flows are estimates based on reporting covering 98 per cent of industry assets, while monthly flows are actual numbers as reported in ICI’s “Trends in Mutual Fund Investing.” Components may not add to the total because of rounding. Other domestic equity represents the sector and alternative strategies investment objectives. World developed markets represents the global equity, international equity, regional equity, and world equity: alternative strategies investment objectives.

IMPORTANT INFORMATION

The information provided in this document does not constitute investment advice and no investment decision should be made based on it. Neither the information contained in this document or in any accompanying oral presentation is a recommendation to follow any strategy or allocation. In addition, neither is a recommendation, offer or solicitation to sell or buy any security or to purchase of shares in any fund or establish any separately managed account. It should not be assumed that any investments made by GQG Partners LLC (GQG) in the future will be profitable or will equal the performance of any securities discussed herein. Before making any investment decision, you should seek expert, professional advice, including tax advice, and obtain information regarding the legal, fiscal, regulatory and foreign currency requirements for any investment according to the law of your home country, place of residence or current abode.

This document reflects the views of GQG as of a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary. GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented and may include the possibility of loss of principal. It should not be assumed that investments made in the future will be profitable or will equal the performance of securities listed herein.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Unless otherwise indicated, the performance information shown is unaudited, pre-tax, net of applicable management, performance and other fees and expenses, presumes reinvestment of earnings and excludes any investor-specific charges. All past performance results must be considered with their accompanying footnotes and other disclosures.

Past performance may not be indicative of future results. Performance may vary substantially from year to year or even from month to month. The value of investments can go down as well as up. Future performance may be lower or higher than the performance presented, and may include the possibility of loss of principal. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of securities listed herein.

The information contained in this document is unaudited. It is published for the assistance of recipients, but is not to be relied upon as authoritative and is not to be substituted for the exercise of one’s own judgment. GQG is not required to update the information contained in these materials, unless otherwise required by applicable law. No portion of this document and/or its attachments may be reproduced, quoted or distributed without the prior written consent of GQG.

GQG is registered as an investment adviser with the U.S. Securities and Exchange Commission. Please see GQG’s Form ADV Part 2, which is available upon request, for more information about GQG.

Any account or fund advised by GQG involves significant risks and is appropriate only for those persons who can bear the economic risk of the complete loss of their investment. There is no assurance that any account or fund will achieve its investment objectives. Accounts and funds are subject to price volatility and the value of a portfolio will change as the prices of investments go up or down. Before investing in a strategy, you should consider the risks of the strategy as well as whether the strategy is appropriate based upon your investment objectives and risk tolerance.

There may be additional risks associated with international and emerging markets investing involving foreign, economic, political, monetary, and/or legal factors. International investing is not for everyone. You can lose money by investing in securities.

Where referenced, the title Partner for an employee of GQG Partners LLC indicates the individual’s leadership status within the organization. While Partners hold equity interests in GQG Partners Inc., as a legal matter they do not hold partnership interests in GQG Partners LLC or GQG Partners Inc.

GQG Partners LLC is a wholly owned subsidiary of GQG Partners Inc., a Delaware corporation that is listed on the Australian Securities Exchange

© 2023 GQG Partners LLC. All rights reserved.

Data and content presented is as of September 30, 2022 and in US dollars (US$) unless otherwise stated.

TLFLI TAXAVA1022