Approach

Our Philosophy

Forward-Looking Quality

GQG’s investment philosophy is rooted in the belief that earnings drive stock prices.

The pursuit of durable earnings ignores the idea of traditional growth and value investing and instead focuses on finding companies we believe have the highest probability of compounding capital over the next five years. This investment style focused on high-quality, durable businesses, is considered by GQG to be more suitably named as “Forward-Looking Quality”.

Investment Process

Search, Analyze

Construct

GQG searches for investment ideas across a broad array of sources.

We seek to fully understand the quality and growth potential of a company on a go-forward basis over a full market cycle. Only after the team identifies a company that it believes is a high-quality business with a durable earnings stream and available at a reasonable price will it be added to the portfolio.

A Differentiated and Comprehensive View

Our Research Mosaic is

Your Investing Edge

It is the diversity of insights that power our research process. GQG’s Research Mosaic brings together traditional and non-traditional research analysts that we believe goes beyond the typical Wall Street approach.

Our team’s ability to make thoughtful investment decisions starts with a flat structure, where honest discussions of ideas and internal criticism are not only encouraged but valued. We believe this to be our competitive edge.

The world is never static. Adapting is key to our ongoing search for quality businesses with strong financials, capable management, and growth opportunities.

Our Portfolio Management Team

Collaborative Diverse

Thinking

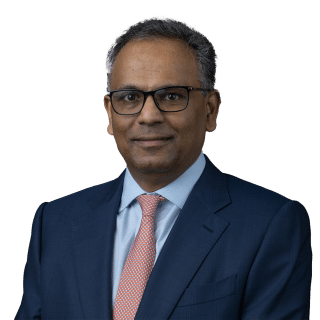

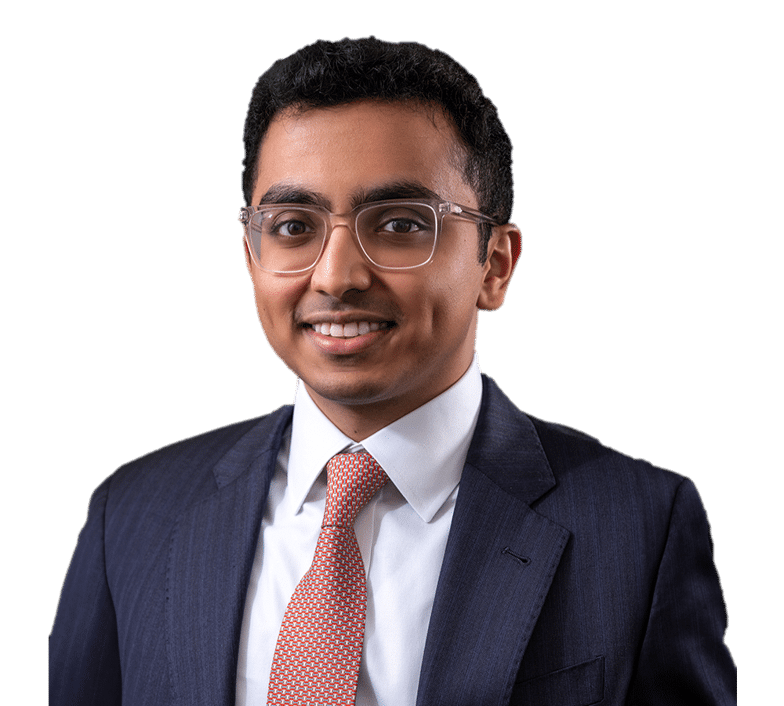

Rajiv Jain, Chairman and Chief Investment Officer, alongside Brian Kersmanc and Sudarshan Murthy are at the helm of the Investment Management Team serving as Portfolio Managers for the GQG Partners portfolios.

Each Portfolio Manager brings years of investment management expertise, an unconventional background, and eclectic viewpoints. Their unique perspectives and collaborative approach demonstrate the firm’s commitment to both best serving and compounding capital for our clients.

Learn About Our Strategies

Rajiv Jain

Chairman & Chief Investment Officer

Brian Kersmanc

Portfolio Manager

Sudarshan Murthy, CFA

Portfolio Manager

Sid Jain

Deputy Portfolio Manager

Our Non-traditional Analyst Team

While our traditional analysts play an integral role in the fundamental, bottom-up stock selection we apply to constructing each portfolio, our non-traditional analysts tell the story behind the numbers.

Composed of former award-winning investigative journalists and domain experts, our non-traditional analysts are an experienced group of professionals from across the globe. The non-traditional analysts aim to mitigate behavior bias through the team’s distinguished skillset, including strategic questioning, language fluency, and diverse perspectives to study companies around the world.

Our ESG Approach

Performing ESG due diligence is more than checking a box on a to-do list for us. It’s always been an innate practice, part of our ethos, because it’s simply good investing.

Understanding the character and quality of the people leading a company allows us to stand behind our investment. We place great value on assuring that an executive team is capable of delivering consistent results, that corporate governance is ethical, compliant and efficient, and that promoting the broader good is valued above all else.

Learn More