Key Takeaways

After a period of stagnation, electricity demand in the US is set to increase significantly due to the expansion of data centers driven by AI technology, widespread EV adoption, and the overall electrification of the economy

Power-hungry facilities like data centers are moving away from traditional hubs, creating demand in more geographically diverse areas

Each EV that replaces an internal combustion engine increases electricity consumption by 80 kWh; this shift could represent a significant percentage of the projected grid capacity by 2040

The era of flat power demand is over. The rise in electricity needs by data centers, low carbon technologies, and electric vehicle (EV) adoption across the US has further increased near-term electricity demand forecasts.

Electricity demand growth in the US remained flat for the past two decades after growing at a 5 percent rate for the second half of the 20th century. Improvements in energy efficiency and outsourcing of major industrial operations to developing countries kept load growth unchanged since the early 2000s.1

Yet major structural changes are occurring that require massive investments in the power sector where electricity demand is expected to grow by at least 2 percent each year for the next two decades.1 The ramp-up in demand is being driven by the rise in data centers and AI, a fuel shift to clean energy, and the electrification of the economy.

Hyperscale Data Centers

In our view, investing in the power and utility sectors is a way to play the AI boom beyond semiconductors and software companies.

A new wave of data center power demand–accelerated by generative artificial intelligence (GenAI)–is 4x to 5x that of traditional data centers, which historically have been concentrated in Loudon County, Virginia.2

The most recent surge in electricity demand from hyperscalers is poised to grow at a 10 percent rate through 2030 and could triple from 2.5 percent in 2022 to 7.5 percent of total electricity consumption in the US. That is the equivalent of the electricity used by about 40 million US homes.3

US Electricity Demand from Datacenters (TWh)

“As AI produces a lot of load growth, utilities aren’t positioned to put a lot of power facilities in place quickly,” said a former infrastructure planning executive at US’ PJM Interconnection. “Utilities and regulators are not preparing well and are already way behind. Of course, that depends on growth of different load segments in any given part of the country.”

The placement of data centers is becoming more geographically diverse, requiring expanding the grid to remote areas and away from the traditional I-66 corridor in northern Virginia. It used to be that data centers needed to be close to the backbone of the internet, near Washington DC, because the internet originated from the federal government. But now data centers are being constructed in California, Ohio, Illinois, Georgia, and Florida, among other regions.

>60% of Total US Data Center Capacity Expected in PJM, MISO, CAISO and Southeast by 2027

Fuel Shifting to Clean Energy

Utilities are increasingly shifting their generation mix from coal to renewables and nuclear energy. Renewable energy generates over 20 percent of all US electricity and is expected to more than double in 15 years. To make the switch to renewables from fossil fuels, the US will need 3x the renewable generation capacity due to the intermittency of solar and wind sources.4

“Texas has about 40,000 megawatts (MWs) of renewables installed, almost half of what its peak demand was last summer of 85,000 MWs. In Texas, where renewables represent almost half of the generation fleet, the intermittency issues are large. During the snowstorm of Christmas 2022, windmills couldn’t turn in those conditions, and solar panels were covered with snow, so those transmission poles and those solar panels sat idle,” said a former executive at the Public Utility Commission of Texas.

Thus, demand for fossil fuels is expected to be more volatile–lower on average but potentially much higher on peak–on days when intermittent renewables are at low generation levels.

Coal demand from the US power sector has declined substantially in absolute terms in recent years, yet the sector is expected to consume 73 percent of US coal this year and 70 percent in 2025.5

Total Annual Consumption of U.S. Coal

Nuclear power plants have generated about 20 percent of US electricity since 1990.6 Prior to 2023, only one new nuclear reactor had come online since 1996. That changed last year when Plant Vogtle Unit 3 in Georgia entered commercial operation while Unit 4 started operations on April 29 of this year. However, we do not believe there are plans to build any additional nuclear plants in the US.

EV Adoption

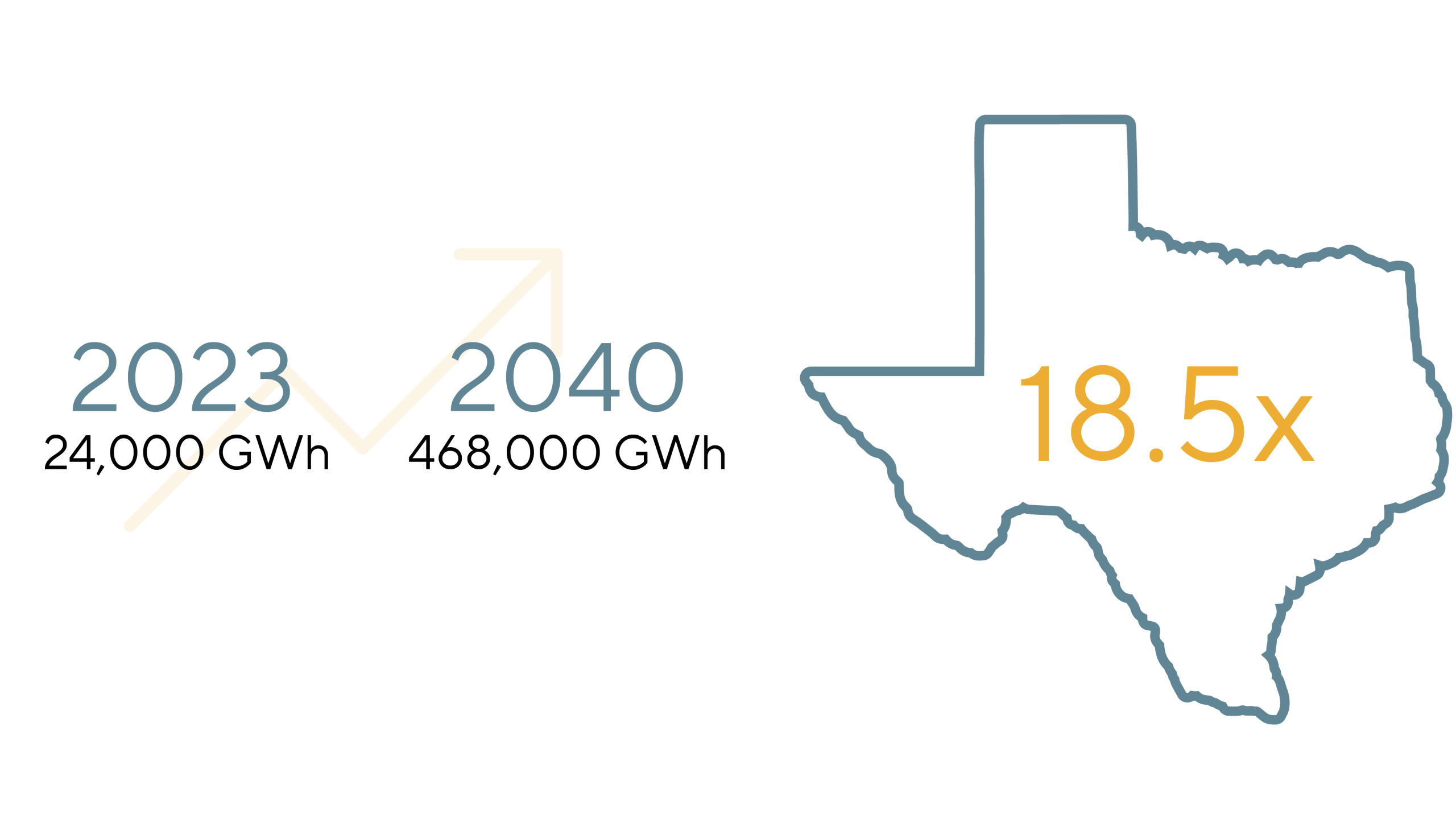

Load growth from EVs has been overlooked. Electricity consumption increases by 80 kilowatts (kW) with every EV that replaces an internal-combustion engine vehicle.7

The average total annual EV load in the US could rise from an estimated 24,000 gigawatts (GW) in 2023 to 468,000 GWh by 2040, according to PwC. That’s an 1,850 percent increase or about as much as the total electricity generated annually in Texas. This EV load could be 9 percent to 12 percent of the projected US grid capacity, which is below current reserve margins, but still could significantly impact load demand and generation needs.7

Given there are 280 million vehicles in the US and EV penetration is at 8 percent, electricity consumed by EVs is expected to grow to 80 percent by 2040 when EV penetration is expected to rise to 323 million which will demand 1000 GW to the grid, or 18 percent of total electricity demand.7

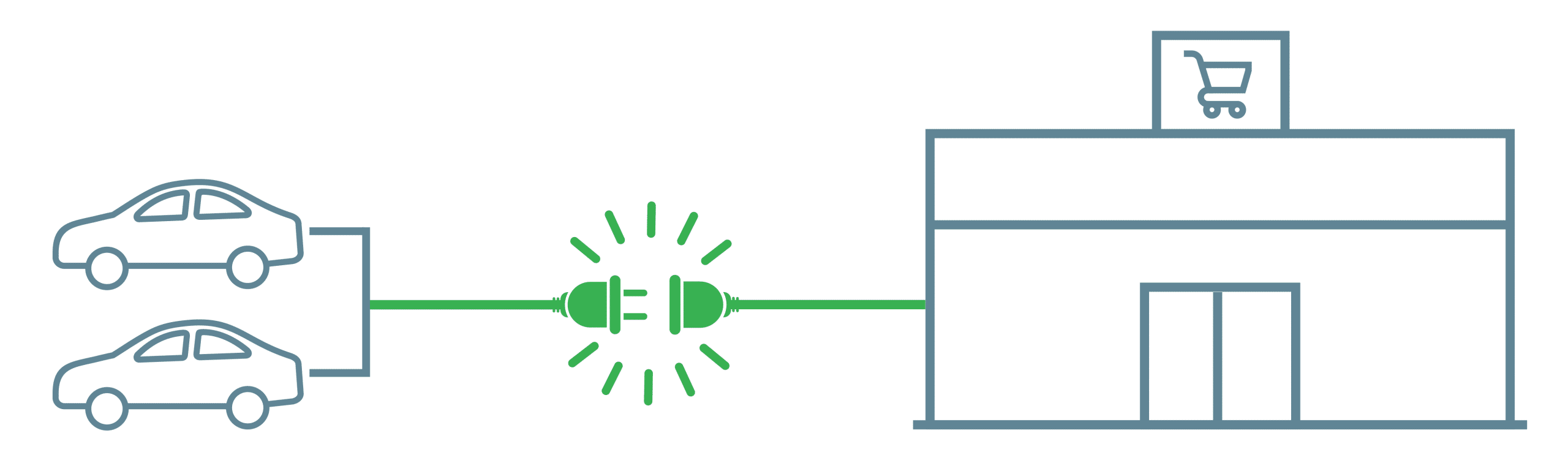

“As EV chargers are built out, not only do they draw a lot of power but the way they draw it is unique and terrifying. Two ultra-fast chargers that replicate the recharge time of an internal-combustion engine draw the same amount of power as a super Walmart,” said a former regulator.

“A grid operator knows when a Walmart is going to be drawing power and when it’s not. Plugging in different ultra-fast EV chargers at different places on the grid at different times is the equivalent of having super Walmarts pop up randomly at random locations. If this demand is something that’s going to come to pass, the amount of transmission interconnectedness, and substations which you would need to address that kind of volatility and establish the flexibility you need is mind-boggling.”

Turbocharged Electricity Demand

The clean energy transition, vehicle electrification, and the rise in GenAI have heightened demand for power and electricity over the next decade, pushing utilities, power generation providers, and grid operators to the limit.

Read more about the

US energy supply available to feed this surge in power demand

FootnoteS

PJM is a regional transmission organization that coordinates the movement of wholesale electricity in all or parts of the North Eastern interconnection grid operating in 13 states and the District of Columbia.

1Gimon , Eric, O’Boyle, Mike, and Solomon, Michelle. “Meeting Growing Electricity Demand Without Gas.” Energy Innovation. March 2024.

2Buddy Rizer, Executive Director for Economic Development in Loudoun Country VA at the Morgan Stanley Powering the Growth of GenAI Symposium on March 26, 2024.

3“Walton, Robert. “US data center electricity demand could double by 2030, driven by artificial intelligence: EPRI”, Utility Dive, May 30, 2024.

4“Frequently Asked Question: What is U.S. electricity generation by energy source?” EIA Independent Statistics and Analysis, eia.gov, February 2024.

5“U.S. coal exports account for larger share of a shrinking market” EIA Independent Statistics and Analysis, eia.gov, January 29, 2024.

6”5 Fast Facts About Nuclear Energy”. Office of Nuclear Energy, energy.gov, June 11, 2024.

7McBride, Sam and Siokos, Konstantinos, .“EV charging growth: How can power and utilities prepare?, PWC.com

IMPORTANT INFORMATION

This information may be distributed by GQG Partners LLC and its affiliates (collectively “GQG”).

This information reflects the views of GQG as at a particular time. GQG’s views may change without notice. Any forward-looking statements or forecasts are based on assumptions and actual results may vary.

GQG provides this information for informational purposes only. GQG has gathered the information in good faith from sources it believes to be reliable, including its own resources and third parties. However, GQG does not represent or warrant that any information, including, without limitation, any past performance results and any third-party information provided, is accurate, reliable, or complete, and it should not be relied upon as such. GQG has not independently verified any information used or presented that is derived from third parties, which is subject to change. Information on holdings, allocations, and other characteristics is for illustrative purposes only and may not be representative of current or future investments or allocations.

NOTICE TO RECIPIENTS IN AUSTRALIA & NEW ZEALAND

The information in this document is issued and approved by GQG Partners LLC (“GQG”), a limited liability company and authorised representative of GQG Partners (Australia) Pty Ltd, ACN 626 132 572, AFSL number 515673. This information and our services may be provided to wholesale and retail clients (as defined in section 761G of the Corporations Act 2001 (Cth)) domiciled in Australia. This document contains general information only, does not contain any personal advice and does not take into account any prospective investor’s objectives, financial situation or needs. In New Zealand, any offer of a Fund is limited to ‘wholesale investors’ within the meaning of clause 3(2) of Schedule 1 of the Financial Markets Conduct Act 2013. This information is not intended to be distributed or passed on, directly or indirectly, to any other person.

NOTICE TO RECIPIENTS IN CANADA (Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Québec, Saskatchewan (the “Canadian Jurisdictions”))

GQG Partners LLC relies on the (i) international adviser exemption pursuant to section 8.26 of NI 31-103 in each of the Canadian Jurisdictions, and (ii) non-resident investment fund manager exemption pursuant to section 4 of MI 32-102 in Ontario and Québec and is not registered as an adviser or investment fund manager in the Canadian Jurisdictions.

This document has been prepared solely for information purposes and is not an offering memorandum or any other kind of an offer to buy or sell or a solicitation of an offer to buy or sell any security, instrument or investment product or to participate in any particular trading strategy. It is not intended and should not be taken as any form of advertising, recommendation, investment advice or invitation to trade. This information is confidential and for the use of the intended recipient only. The distribution of this document in Canada is restricted to recipients who are qualified “permitted clients” for purposes of National Instrument 31-103 Registration Requirements, Exemptions and Ongoing Registrant Obligations. This document may not be reproduced, redistributed or copied in whole or in part for any purpose without the prior written consent of GQG. Upon receipt of this document, each Canadian recipient hereby confirms having expressly requested that all documents evidencing or relating in any way to the information described herein be drawn up in the English language only. Par la réception de ce document, le détenteur au Canada de celui-ci confirme par les présentes avoir expressément exigé que tous les documents faisant foi ou se rapportant de quelque manière que ce soit aux informations présentées dans ce document soient rédigés en anglais seulement.

NOTICE TO RECIPIENTS IN SOUTH AFRICA

GQG PARTNERS LLC is an authorised financial services provider in the Republic of South Africa and regulated by the Financial Sector Conduct Authority (FSCA) with FSP number: 48881. Investors should take cognisance of the fact that there are always risks involved when buying or selling any financial product. Past performance of a financial product is not necessarily indicative of future performance. The value of financial products can increase as well as decrease over time, depending on the value of the underlying securities and prevailing market conditions. The investment value of a financial product is not guaranteed, and any illustrations, forecasts or hypothetical data are provided for illustrative purposes only. This document does not constitute financial advice, a solicitation, invitation or investment recommendation. Prior to selecting a financial product or investment, it is recommended that South African based investors seek and obtain specialised financial, legal and tax advice.

NOTICE TO RECIPENTS IN THE UNITED KINGDOM

GQG Partners LLC is not an authorised person for the purposes of the Financial Services and Markets Act 2000 of the United Kingdom (“FSMA”) and the distribution of this document in the United Kingdom is restricted by law. Accordingly, this document is provided only for and is directed only at persons in the United Kingdom reasonably believed to be of a kind to whom such promotions may be communicated by a person who is not an authorised person under FSMA pursuant to the FSMA (Financial Promotion) Order 2005 (the “FPO”). Such persons include: (a) persons having professional experience in matters relating to investments; and (b) high net worth bodies corporate, partnerships, unincorporated associations, trusts, etc. falling within Article 49 of the FPO. The services provided by GQG Partners LLC and the investment opportunities described in this document are available only to such persons, and persons of any other description may not rely on the information in it. All, or most, of the rules made under the FSMA for the protection of retail clients will not apply, and compensation under the United Kingdom Financial Services Compensation Scheme will not be available.

GQG Partners (UK) Ltd. is a company registered in England and Wales, registered number 1175684. GQG Partners (UK) Ltd. is an appointed representative of Sapia Partners LLP, which is authorised and regulated by the Financial Conduct Authority (“FCA”) (550103).

NOTICE TO RECIPIENTS IN ADGM

GQG Partners Ltd, a company limited by shares, registered in Abu Dhabi Global Markets (“ADGM”), having its address at Unit 12, 7th Floor, Al Khatem Tower, Al Maryah Island, Abu Dhabi, United Arab Emirates. GQG Partners Ltd is licensed by the ADGM’s Financial Services Regulatory Authority (FSRA) (license number 240015). GQG Partners Limited is licensed by the ADGM’s Financial Services Regulatory Authority (FSRA) to conduct the regulated activities of Managing a Collective Investment Fund, Advising on Investments or Credit, Arranging Deals in Investments, Managing Assets, Shari’a-compliant Regulated Activities. This document is intended for distribution only to persons of a type specified in the FSRA’s Rules (i.e., “Professional Clients”) and must not be delivered to or relied on by any other type of person. It is for the exclusive use of the persons to whom it is addressed and in connection with the subject matter contained therein. The FSRA, or any other regulatory authority, has no responsibility for reviewing or verifying this document or any other document in connection with it. Accordingly, the FSRA, or any other regulatory authority, neither approved this document or any other associated documents nor taken any steps to verify the information set out in this document and has no responsibility for it.

© 2024 GQG Partners LLC. All rights reserved. This document reflects the views of GQG as of September 2024.

TL PWRIMBL-1 0724